Ottawa Real Estate Statistics

Real Estate Newsletter

June 2018

Ottawa Real Estate Statistics

April 2018

Real Estate Newsletter

May 2018

Bidding Wars Intensify in Ottawa

Multiple offers on homes and properties going for over asking is happening more and more in Ottawa. This morning I noticed a couple of listings that increased in price: not something you see regularly, at least not in the past. We are definitely in a seller’s market. Great time to sell but potentially more challenging when buying.

Real Estate Newsletter

April 2018

Ottawa Real Estate Statistics

March 2018

Ottawa Real Estate Board (OREB)

Latest News Release

Buyers Get a Jump on the Spring Market

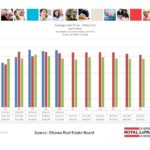

OTTAWA, April 5, 2018 – Members of the Ottawa Real Estate Board sold 1,660 residential properties in March through the Board’s Multiple Listing Service® System, compared with 1,478 in March 2017, an increase of 12.3 per cent. The five-year average for March sales is 1,339. March’s sales included 358 in the condominium property class and 1,302 in the residential property class.

“Inventory continues to fall below normal average, but we are still seeing more sales than last year because listings are not staying on the market,” states Ralph Shaw, President of the Ottawa Real Estate Board. “Properties that are priced well are selling quickly with days on market dropping to an average of 43 days from an average of 54 days on market in March 2017.”

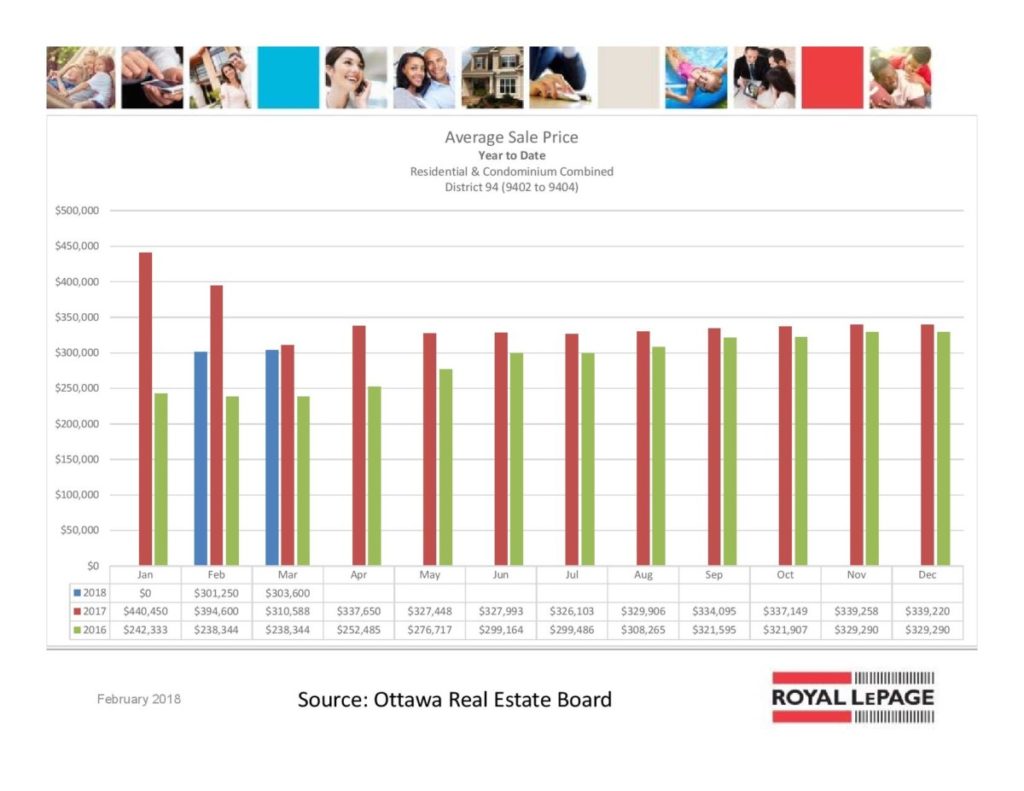

The average sale price of a residential-class property sold in March in the Ottawa area was $447,561, an increase of 8 per cent over March 2017. The average sale price for a condominium-class property was $275,592, an increase of 0.7 per cent from March 2017. The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

“The most active price point in the residential market continues to be the $300,000 to $449,999 range, accounting for 46 per cent of the market. In addition, the $500,000 to $750,000 market is a price point that is showing robust growth representing 21 per cent of the residential homes sold in March,” Shaw acknowledges.

“In the condominium market, between $175,000 and $274,999 is the most buoyant price point, accounting for 51 per cent of the market. We continue to believe it is due to low interest rates and the lack of supply of rental inventory pushing renters into the market,” he adds.

“Overall, as a result of the stable pricing in the condominium market and reasonable increases of 8 per cent in the residential market, Ottawa continues to be a healthy and vibrant real estate market,” Shaw concludes.

In addition to residential and condominium sales, OREB Members assisted clients with renting 551 properties since the beginning of the year.

CREA – Canadian Real Estate Association Statistics

The Canadian Real Estate Association released it’s statistics for February 2018 yesterday.

I always caution readers to remember that Toronto and Vancouver represent two of the largest markets in the country and tend to sway the figures greatly. That being said the highlights are as follows:

- National home sales declined by 6.5% from January to February.

- Actual (not seasonally adjusted) activity was down 16.9% year-over-year (y-o-y) in February.

- The number of newly listed homes recovered by 8.1% from January to February.

- The MLS® Home Price Index (HPI) in February was up 6.9% y-o-y.

- The national average sale price declined by 5% y-o-y in February.

- « Previous Page

- 1

- …

- 44

- 45

- 46

- 47

- 48

- …

- 55

- Next Page »