[Read more…]

[Read more…]Ottawa Real Estate Board (OREB)

Latest News Release

Hot Market in a Scorching July

OTTAWA, August 6, 2019 – Members of the Ottawa Real Estate Board sold 1,842 residential properties in July through the Board’s Multiple Listing Service® System, compared with 1,605 in July 2018, an increase of 14.8 per cent. July’s sales included 1,382 in the residential-property class, up 12.3 per cent from a year ago, and 460 in the condominium-property category, a rise of 23 per cent from July 2018. The five-year average for July unit sales is 1,579.

“Typically, after the busy spring, July tends to be a slower month as people take vacations and spend more time with their families, but there was no slow down this past month,” observes Dwight Delahunt, President of the Ottawa Real Estate Board. “In fact, we recorded the highest number of July sales in 15 years.”

“Also, for the first time in 2019, there was an upsurge in new listings which has slightly improved housing inventory. Although this is encouraging news, it is not enough to keep up with demand. In order to bring about a more balanced market, there needs to be at least a three-month supply of listings. Currently, Ottawa is closer to a one-month supply,” he adds.

“In this type of market, it is vital that Sellers utilize the experience and advice of a REALTOR® to maximize your property’s potential — and if you are a Buyer, to guide you through the complexities this intricate market presents,” Delahunt recommends.

July’s average sale price for a condominium-class property was $299,665, an increase of 6.8 per cent from last year while the average sale price of a residential-class property was $487,308, an increase of 10.4 per cent from a year ago.*

“Residential house prices continue to increase; however, these are reasonable gains and are not creating a bubble by any stretch,” Delahunt maintains. “Condo prices have now recovered, and the oversupply in that sector no longer exists. Ottawa has a healthy condo market and with major developments coming online in the future, we expect these too will be absorbed in due course.”

The $350,000 to $499,999 price range was the most prevalent price point in the residential market, accounting for 42 per cent of July’s transactions while 28 per cent of residential sales were in the $500,000 to $749,999 range. The most active price point in the condominium market, $225,000-$349,999, accounts for 52 per cent of the units sold.

When asked about how the upcoming federal election might affect the real estate market, Delahunt emphasizes, “We continue to believe the stress test is negatively impacting our housing market and look forward to hearing about how the various parties intend on addressing this contentious issue as the election approaches.”

In addition to residential sales, OREB Members assisted clients with renting 1,619 properties since the beginning of the year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

OREB Ottawa Real Estate Board Statistics

June 2019

Ottawa Real Estate Newsletter – July 2019

Ottawa Real Estate Board (OREB)

Latest News Release

Condo Sales Continue to Dominate Resale Market

OTTAWA, July 4, 2019 – Members of the Ottawa Real Estate Board sold 2,105 residential properties in June through the Board’s Multiple Listing Service® System, compared with 2,064 in June 2018, an increase of 2 per cent. June’s sales included 1,612 in the residential-property class, on par with a year ago, and 493 in the condominiumproperty class, a rise of 8.8 per cent from June 2018. The five-year average for June unit sales is 2,002.

“Year to date residential resales are virtually the same as this time last year with 7,565 transactions so far,” announces Dwight Delahunt, Ottawa Real Estate Board President. “Increasing by 8.3%, condo resales are the driving force for the upturn in units sold in the first half of 2019. Combined residential and condo year to date sales of 9,876 show a 1.8 per cent increase from June 2018,” he adds.

June’s average sale price for a condominium-class property was $308,482, an increase of 6.2 per cent from last year while the average sale price of a residential-class property was $500,716, a rise of 11.4 per cent from a year ago. *

“Although, the percentage increase in average price for a residential property climbed into the double digits in June, year to date figures indicate a steady growth of 7.6 per cent and 7.5 per cent for residential and condominiums respectively.”

“In the past decade, we have seen an approximate 52% increase in average prices for residential properties and 34% for condominiums, indeed an excellent return on investment for homeowners,” states Delahunt. “With a population reaching one million residents according to the City of Ottawa, we truly enjoy a high quality of living and remain one of Canada’s most affordable major cities – that’s no small feat.”

The $350,000 to $499,999 price range was the most prevalent price point in the residential market, accounting for 43 per cent of June’s transactions while 29 per cent of residential sales were in the $500,000 to $749,999 range. The most active price point in the condominium market for the third straight month, $225,000-$349,999, accounts for 55 per cent of the units sold.

“Some areas of the city are experiencing multiple offers, and the competition for well-priced and positioned properties is brisk. Even though 39% of properties this month sold above the asking price, the vast majority of properties are still being sold at or below the listed price,” Delahunt points out. “A professional REALTOR’S® market knowledge and neighbourhood expertise are invaluable whether you are a buyer or a seller,” he maintains.

“This is not a speculation market. Going forward, we anticipate there will be a high demand in the foreseeable future due to increasing population and strong employment in the area. We are pleased to see all levels of government starting to address the supply side issue, but we feel there is still work to be done. We will be watching the upcoming federal election closely to gain insight as to how the various parties intend on addressing attainable homeownership issues,” Delahunt concludes.

In addition to residential sales, OREB Members assisted clients with renting 1,314 properties since the beginning of the year, and our Commercial Members continue to be very active in our marketplace.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

The Current Ottawa Real Estate Market

A couple of interesting articles. The first one How Ottawa became the country’s hottest real estate market and the second how Ottawa’s condo market drives increase in May home sales.

Do not hesitate to contact the Molly & Claude Team for a personal assessment of how all of this affects you.

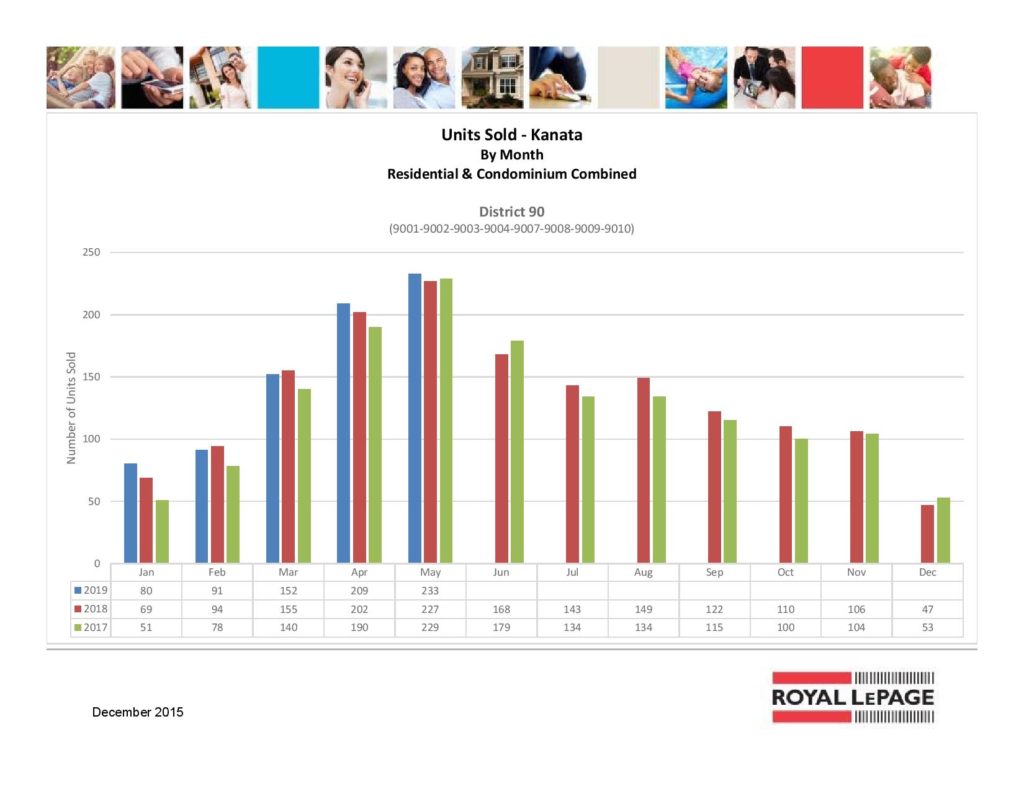

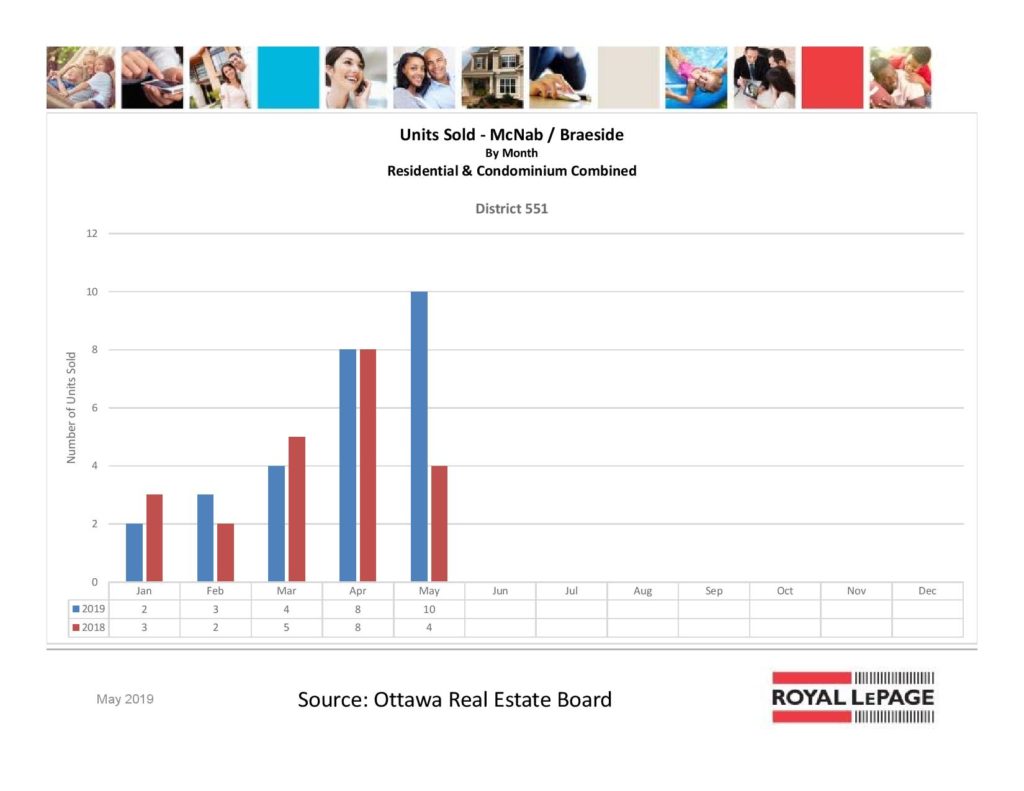

OREB Ottawa Real Estate Board Statistics

May 2019

Real Estate Newsletter – June 2019

Ottawa Real Estate Board (OREB)

Latest News Release

Blossoming Condo Market Bolsters May Releases

OTTAWA, June 5, 2019 – Members of the Ottawa Real Estate Board sold 2,423 residential properties in May through the Board’s Multiple Listing Service® System, compared with 2,271 in May 2018, an increase of 6.7 per cent. May’s sales included 1,869 in the residential property class, an increase of 4.6 per cent from a year ago, and 554 in the condominium property class, an increase of 14.2 per cent from May 2018. The five-year average for May unit sales is 2,167.

“Despite the continuous freefall of inventory levels, we still have a higher sales volume than this time last year,” observes Dwight Delahunt, Ottawa Real Estate Board’s President. “Well priced and positioned properties are turning over quickly with residential days on market declining an average of 28 days compared to 34 days last May and a whopping 33 per cent decrease for the condominium market from 46 days to 31 days.”

“Condo sales are bolstering the resale market, up 14 per cent from a year ago, and are providing an excellent opportunity for those wishing to enter the market or are ready to downsize,” he adds.

May’s figures show the average sale price for a condominium-class property was $297,731, an increase of 5.8 per cent from last year while the average sale price of a residential-class property was $493,691, a rise of 6.4 per cent from a year ago. Year to date numbers show a 6.6 per cent and 7.9 per cent increase in average prices for residential and condominiums respectively. *

“Home prices are steadily increasing at a reasonable rate, and the fact that they are not spiking confirms that our market is healthy and sustainable,” Delahunt points out. “Although we hear about extreme multiple offer situations, the fact is, 62 per cent of homes are still selling at or below asking.”

“Certainly, there are 15 per cent more listings selling above asking compared to this time last year, but these are restricted to particular pockets of the city. There are still many opportunities for those who want to find an affordable property. This is where the knowledge and experience of a REALTOR® will serve you well. They understand Ottawa’s neighbourhoods, market trends, and property values and can efficaciously guide you in your home sale or search,” Delahunt advises.

The $350,000 to $499,999 price range was the most active price point in the residential market, accounting for 42 per cent of May’s transactions while 28 per cent of residential sales were in the $500,000 to $749,999 range. The most prevalent price point in the condominium market, which had increased to the $225,000-$349,999 price range two months ago, accounts for 57 per cent of the units sold.

In addition to residential and condominium sales, OREB Members assisted clients with renting 1,043 properties since the beginning of the year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

- « Previous Page

- 1

- …

- 39

- 40

- 41

- 42

- 43

- …

- 55

- Next Page »