The Molly & Claude Team Realtors Ottawa, Royal LePageTeam Realty

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin

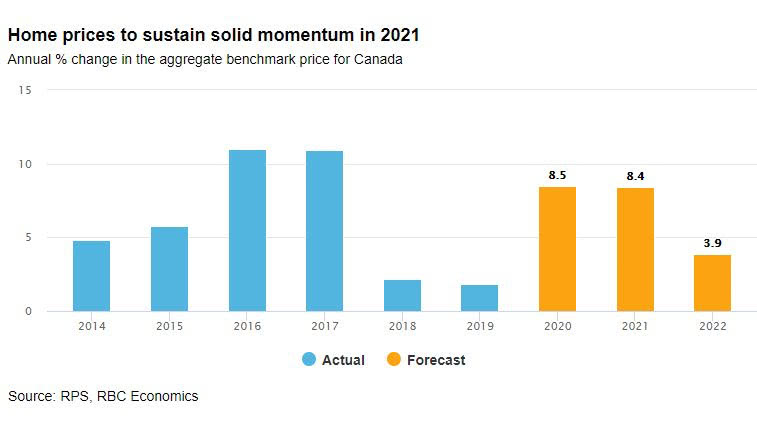

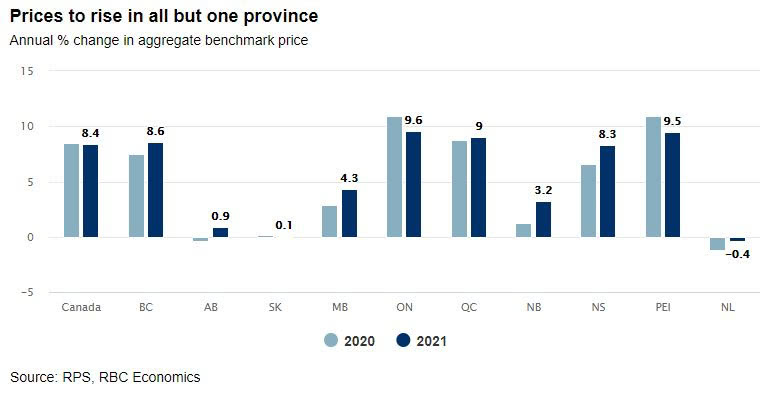

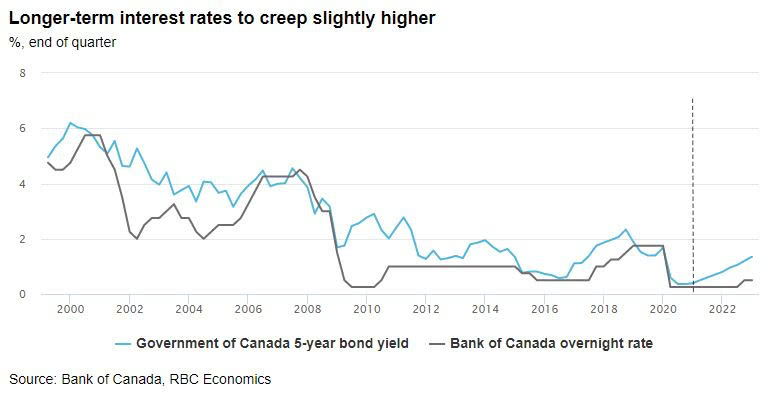

High sensitivity to interest rates poses a potential risk…

High sensitivity to interest rates poses a potential risk…

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin