[Read more…]

[Read more…]Ottawa Real Estate News Release (OREB) – March Resales Go Out Like a Lion

OTTAWA, April 7, 2021 – Members of the Ottawa Real Estate Board sold 2,285 residential properties in March through the Board’s Multiple Listing Service® System, compared with 1,514 in March 2020, an increase of 51 per cent. March’s sales included 1,705 in the residential-property class, up 47 per cent from a year ago, and 580 in the condominium-property category, an increase of 65 per cent from March 2020. The five-year average for total unit sales in March is 1,688.

“A few factors contributed to the high number of resales in March,” states Ottawa Real Estate Board President Debra Wright. “Typically, real estate is heavily influenced by the weather, and we had remarkable and unseasonably warm temperatures last month, which facilitated Buyers’ ability to view and purchase homes.”

“Also, there was a significant uptick in the number of new listings that came onto the market. This total (2,798) was higher than the 5-year listing average, which hadn’t happened since July 2020, when the first lockdown ended. Ongoing pent-up Buyer demand meant that most of the properties that came on the market in March were quickly acquired.”

“Meanwhile, the 51% increase in transactions over last year can be attributed to the State of Emergency, which commenced mid-March 2020 and impacted overall sales that month. Measuring against a drastically reduced comparable made this year’s figure jump,” Wright points out.

“Although the percentage of sales comparison may be somewhat skewed, multiple offers scenarios are undoubtedly escalating property values. Statistics show that in March 2021, almost 80% of the resales in the Ottawa area sold for more than the asking price compared to 60% at this time last year. However, this is not the case in every instance and the balance sold with 6% selling at the list price and the other 14% selling for less than the list price.”

March’s average sale price for a condominium-class property was $437,041, an increase of 18 per cent from last year, while the average sale price for a residential-class property was $758,802, an increase of 35 per cent from a year ago.With year-to-date average sale prices at $729,897 for residential and $415,054 for condominiums, these values represent a 32 per cent and 17 percent increase over 2020, respectively.*

“These accelerated price growths are purely a result of long-term inventory shortage. I don’t believe that Ottawa’s market is by any means out of control but rather is coming into its own. However, until there is action at all three levels of government to resolve our supply challenges, our housing prices are not going to stabilize. And this phenomenon is not occurring in our market alone; housing stock scarcity is a nation-wide issue.”

“We have already seen an upturn in new listings coming onto the market, and we are hopeful this trend will continue. In fact, there may be some pent-up supply as Sellers have held back during the pandemic even though the market has been more active than expected throughout.”

“Sellers will benefit from the advice of a REALTOR® who can ensure they are marketing and pricing their properties competitively and strategically. At the same time, Buyers continue to be challenged with a shortage of offerings and need to be equally strategic with the guidance of their REALTOR®,” Wright concludes.

OREB Members also assisted clients with renting 1,079 properties since the beginning of the year compared to 746 at this time last year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Ottawa Real Estate Statistics – February 2021 – Community Stats

Ottawa Real Estate Newsletter – March 2021

Ottawa Real Estate News Release (OREB) – February Resales Snapped up Quickly

OTTAWA, March 3, 2021 – Members of the Ottawa Real Estate Board sold 1,390 residential properties in February through the Board’s Multiple Listing Service® System, compared with 1,134 in February 2020, an increase of 23 per cent. February’s sales included 1,028 in the residential-property class, up 24 per cent from a year ago, and 362 in the condominium-property category, an increase of 19 per cent from February 2020. The five-year average for total unit sales in February is 1,101.

[Read more…]

Royal LePage Survey

Nearly half of Canadians aged 25 to 35 own their home; one quarter of these homeowners have purchased a property since the onset of the COVID-19 pandemic

52% say remote work has increased likelihood of moving further from employer

Highlights:

- 68% of non-homeowners aged 25 to 35 intend to purchase a home within five years

- 72% of cohort feels confident in their short-term financial outlook

- 40% of cohort saw their savings grow since mid-March

- Royal LePage survey includes national, regional and city-level insights

TORONTO, February 25, 2021 – According to a recent Royal LePage demographic survey[1], nearly half (48%) of Canadians aged 25 to 35 currently own their home, and 25 per cent of these homeowners purchased a property during the pandemic. Among non-homeowners, there is a strong intention to purchase in the future (84%), with 68 per cent planning to make the move in the next five years. Sixteen per cent say they plan to purchase a property within the year, while 14 per cent say they will buy within one to two years, and 39 per cent are looking to purchase in two to five years.

TORONTO, February 25, 2021 – According to a recent Royal LePage demographic survey[1], nearly half (48%) of Canadians aged 25 to 35 currently own their home, and 25 per cent of these homeowners purchased a property during the pandemic. Among non-homeowners, there is a strong intention to purchase in the future (84%), with 68 per cent planning to make the move in the next five years. Sixteen per cent say they plan to purchase a property within the year, while 14 per cent say they will buy within one to two years, and 39 per cent are looking to purchase in two to five years.

“The pandemic provided an unexpected prize for young Canadians — a path to home ownership,” said Phil Soper, president and CEO, Royal LePage. “Mortgage rates fell to historically low levels and the competition for entry-level housing lessened. Many investors sought to divest of property as traditional renter groups such as foreign students, new immigrants and short-term renters disappeared behind closed borders.”

Soper noted that much higher than typical demand from this cohort, combined with older homeowners who have been generally more reluctant to put their property on the market during the pandemic, has contributed to a near-crisis shortage of listings in parts of the country.

“Measures necessary to prevent the spread of COVID-19 have motivated many of our younger Canadians to buy, while the health crisis dissuaded many of our older homeowners from selling,” continued Soper. “Some young people living with parents or roommates found their work-from-home environment uncomfortably crowded. Others saw a once-in-a-decade affordability window open on their dream of home ownership. On the other hand, many older homeowners whose homes are adequate for changed employment circumstances have delayed their desire for a housing upgrade until the medical crisis is under control.”

Confidence in Canadian real estate is strong and despite economic challenges related to the pandemic, Canadians aged 25 to 35 have a healthy personal financial outlook. Ninety-two per cent of those surveyed agree that owning a home is a good financial investment. Seventy-two per cent are confident in their short-term financial outlook and 78 per cent are confident in their long-term financial future. Many (40%) have even seen their savings grow since the onset of the pandemic, and 11 per cent saw a significant increase.

“In many ways, the pandemic has sucked the joy out of our normally kinetic young adults’ lives. No dining out, no concerts with friends or winter escapes to the sunny south. Even retail therapy has lost its luster when no one will see those new shoes on the next Zoom call. The silver lining is in soaring savings; unspent money that is finding its way into real estate investments,” said Soper.

Nearly two thirds of Canadians in this age group (63%), who are employed or seeking employment, say the ability to work for an employer that allows the option of remote work is important, a fact that is not surprising given the volume of sales in regions outside of the major urban centres since the onset of the pandemic. Fifty-two per cent said the availability of remote work has increased their likelihood to move further from their current or future place of work. Overall, 39 per cent of this age group are considering a move from their current home to a less dense area as a result of the pandemic, while 46 per cent said the pandemic had no impact on their desire to move to a less dense area.

When given the choice, 45 per cent of those aged 25 to 35 said they’d prefer to live in a city. Similarly, 47 per cent said they would choose small town or country living. The top responses for the most attractive feature of living in a city are walkability (21%) and access to events, attractions and other entertainment options (21%), followed by diversity of people and cultures (18%), and more employment opportunities (17%). The top reasons for wanting to move to a less dense area are access to more outdoor space (62%) and lower home prices (61%), followed by the affordability of larger properties (51%).

Experts across the country noted young buyers felt comfortable with the safety measures in place around the home buying process during the pandemic.

“Younger buyers are exceedingly comfortable with online research, be it for the latest personal tech, a pair of running shoes, or a home,” said Soper. “This group has had no problem adapting to our enhanced use of virtual tours and electronic contracts. We expect the pandemic will have permanently accelerated the acceptance among our clients of using many of our emerging home buying and selling technologies.”

Royal LePage 2021 Demographic Survey (full national, regional and city-level results): rlp.ca/table_2021demographicsurvey

Regional Insights

Ontario

In Ontario, 44 per cent of residents aged 25 to 35 own their home. Of those homeowners, 26 per cent purchased a home since mid-March of last year. Among those who do not currently own a home, 68 per cent say they intend to buy within the next five years.

Ontarians in this cohort largely believe that home ownership is a good investment (92%), and nearly half of those surveyed (41%) say their savings have increased since last March. Record low mortgage rates and the option to work from virtually anywhere continue to draw young buyers to markets across the province.

In the Greater Toronto Area, 46 per cent of respondents say the pandemic has increased their desire to move to a less densely populated area.

“The pandemic has put a lot of things into perspective, especially for first-time home buyers,” said Tom Storey, real estate agent at Royal LePage Signature Realty in Toronto. “Most of my 25- to 35-year-old clients have fit into one of three distinct buying scenarios over the last year: the softer condo market and low interest rates allowed renters to become owners; move-up buyers who had purchased a condominium a few years ago were able to turn that equity into a down payment on a larger property in the suburbs; or they’ve left the city altogether for a significantly larger space in more affordable places like Hamilton, Guelph, or even cottage country.”

Storey added that this cohort is not expecting to find their dream home straight out the gate. They are interested in taking advantage of some extra savings and low borrowing costs, to invest in a property that has appreciation potential.

While remaining an affordable alternative to Toronto and Vancouver, Ottawa has seen its housing market appreciate over the last few years, due in part to increased demand from both local and out-of-town buyers, many in the age range of 25 to 35.

“Homes near Ottawa’s downtown have now become unattainable for some in this age group and many buyers look in the various suburbs outside the city centre, which are only a short drive away,” said Justin Millette, sales representative at Royal LePage Team Realty. “Since the start of the pandemic, my clients’ priorities have shifted from location to space and affordability, and the lack of inventory is piling on added pressure to try and get into the market as soon as possible. There is a sense they may be priced out of certain areas if they don’t act quickly.”

Millette added that since last March, he’s seen an increase in younger buyers seeking larger properties, as well as current homeowners looking to upsize. Millette expects to see a shift back to the city once the pandemic is over, especially among this group.

Seventy-one per cent and 75 per cent of those surveyed in Ontario feel confident in their short-term and long-term personal financial outlook, respectively. Forty-three per cent say their desire to move to a less dense area has increased since the onset of the pandemic, and 56 per cent say the option of remote work has increased their likelihood of moving further away from their employer.

Royal LePage 2021 Demographic Survey (full national, regional and city-level results): rlp.ca/table_2021demographicsurvey

Quebec

In Quebec, demand from buyers aged 25 to 35 has flooded the suburban real estate market over the past year, spurred by low interest rates, the ability to work remotely and the desire to invest in long-term quality of life.

According to the survey, 50 per cent of this cohort in Quebec own their home, compared to 48 per cent in Canada. Of those young Quebec homeowners, 18 per cent purchased a home since mid-March of last year, while 28 per cent of homeowners located in Montreal have purchased a home since the onset of the pandemic, the highest rate among the cities surveyed.

When asked about their intention to buy a property, 17 per cent of Quebec respondents who do not own a property in this cohort said they plan to buy this year, compared to 19 per cent of those living in Montreal. The proportion reaches 69 and 68 per cent respectively, among Quebec and Montreal respondents who do not currently own a home and have the intention to buy within the next five years.

According to Roxanne Jodoin, residential real estate broker, Royal LePage Privilège in Saint-Bruno-de-Montarville, millennials currently are the critical mass of buyers in the Greater Montreal Area.

“Low interest rates and the ability to work from home are the main drivers for young buyers today. Many are also returning to their roots,” said Jodoin. “Some left their childhood homes in the suburbs to go to University in the city but the current economic situation is driving them back home where they can enjoy more square footage, a yard and a space they can call their own. Becoming a homeowner is increasingly important to this generation and it is clear that many of them are taking steps to make that happen.”

The survey results confirm this trend, with 93 per cent of Quebec respondents saying that buying a property is a good financial investment, the second highest region in the country behind the Prairies.

“The real estate market is still very competitive. The clients I assist in buying a property are resilient and persistent. I am impressed by their determination, their financial capacity and desire to invest,” added Jodoin.

According to the survey, Quebecers aged 25 to 35 are the most confident in the country when asked about their financial future. Seventy-eight per cent and 86 per cent of those surveyed in the province say they feel confident in their short-term and long-term personal financial outlook, respectively.

“Multiple-offer situations and bids over the asking price can make the buying process overwhelming. I encourage young buyers to make balanced decisions and make offers on properties that will keep a good value over the years,” concluded Jodoin.

Royal LePage 2021 Demographic Survey (full national, regional and city-level results): rlp.ca/table_2021demographicsurvey

British Columbia

In British Columbia, 49 per cent of residents aged 25 to 35 own their home. Of those homeowners, 27 per cent purchased a home since mid-March of last year. Among those who do not currently own a home, 65 per cent say they intend to buy within the next five years.

Strong demand from buyers aged 25 to 35 continues to drive sales in Western Canada. As is the case from coast to coast, many young Canadians in British Columbia (41%) have seen their savings grow since the onset of the pandemic, which has been an important factor in their decision to purchase a home during this time, along with historically low interest rates.

“Low interest rates are oxygen for the market,” said Adil Dinani, sales representative at Royal LePage West Real Estate Services in Greater Vancouver. “Younger buyers have a positive association with home ownership. They see the value in it and they’ve done the math. Currently, a monthly mortgage payment can equate to little more than renting.”

Ninety-one percent of those surveyed in the province believe that home ownership is a good investment. Dinani noted that clients in this age group are thinking more long-term, and low interest rates have made it possible for them to purchase a larger starter home.

“Over the last year, I’ve noticed a shift in priorities where first-time buyers are increasingly valuing size and outdoor space over location,” said Dinani.

Seventy-one per cent and 72 per cent of those surveyed in B.C. feel confident in their short-term and long-term personal financial outlook, respectively. Dinani expects activity among this cohort to remain high this spring and throughout the coming year.

Royal LePage 2021 Demographic Survey (full national, regional and city-level results): rlp.ca/table_2021demographicsurvey

Alberta

At 56 per cent, Alberta boasts Canada’s highest home ownership rate among those aged 25 to 35. Of those homeowners, 24 per cent purchased a home since mid-March of last year. Among those who do not currently own a home, 71 per cent say they intend to buy within the next five years.

While Alberta’s housing market has remained steady and balanced in recent years, the COVID-19 pandemic has spurred activity among younger buyers, especially in its urban centres. Thirty-seven per cent of Albertans aged 25 to 35 say they’ve seen their savings grow since the onset of the pandemic.

“With a boost in savings from not spending over the past year, many first-time buyers have been able to accelerate their plans by one or two years,” said Doug Cabral, real estate agent at Royal LePage Benchmark. “With the affordability of homes and low interest rates, combined with an increase in down payment, this group has been able to use this time to their advantage.”

Lifestyle, community, ample living and outdoor space, as well as potential resale value are all important factors in the decision-making process for young buyers. Cabral noted a recent increase in activity from out-of-province buyers, namely from B.C. and Ontario.

“Someone from Vancouver or Toronto has real buying power in a city like Calgary, where they can get a lot more space for their money,” said Cabral. “Square footage and improved lifestyle are top priorities for clients across the board.”

Sixty-six per cent and 79 per cent of those surveyed in Alberta feel confident in their short-term and long-term personal financial outlook, respectively. Cabral expects to see a strong spring market, and anticipates that homeowners in the upper end of the market may be looking to leverage equity in their homes to put towards an investment or recreational property.

Royal LePage 2021 Demographic Survey (full national, regional and city-level results): rlp.ca/table_2021demographicsurvey

Saskatchewan and Manitoba

In the Prairie provinces, 53 per cent of residents aged 25 to 35 own their home. Of those homeowners, 32 per cent purchased a home since mid-March of last year. Among those who do not currently own a home, 65 per cent say they intend to buy within the next five years.

“Most of my clients are first-time buyers in the 25 to 35 age range, currently living at home with family,” said Daniella Payne, sales representative at Royal LePage Prime Real Estate in Winnipeg. “While they know they will likely not win the first home they bid on, they are very motivated and are looking to take advantage of low interest rates and increased savings. They believe working from home, at least in part, is a long-term inevitability and want to ensure they have ample space to work and live comfortably.”

Many young buyers in the area are expanding their searches to include neighbourhoods on the outskirts of major cities, where there is more inventory and more space. Forty-one per cent of the cohort say that the COVID-19 pandemic has increased their desire to move to a less dense area. Payne advises new homebuyers to be prepared to act quickly in order to be successful.

“Buyers should discuss their budget and location preferences, and get their financing in order before they begin their search. If they find their dream home, the window to make an offer can be short on well-priced properties in popular neighbourhoods,” said Payne.

Thirty-six per cent of Canadians aged 25 to 35 in the Prairies have seen their savings increase since mid-March 2020. Seventy-three per cent and 80 per cent of those surveyed in Saskatchewan and Manitoba feel confident in their short-term and long-term personal financial outlook, respectively. Payne expects another year of strong activity from the cohort, especially if interest rates remain low.

Royal LePage 2021 Demographic Survey (full national, regional and city-level results): rlp.ca/table_2021demographicsurvey

Atlantic Canada

In Atlantic Canada, 48 per cent of residents aged 25 to 35 own their home. Of this group, 42 per cent have purchased a home since mid-March of last year, the highest of all regions surveyed. Of those who do not currently own a home, 75 per cent say they intend to buy within the next five years.

The ability to work remotely and not be tied to a long commute has made young buyers in the Maritimes think about what they really want in a home. Forty-six per cent of those surveyed, who are employed or seeking employment, say the option of remote work has increased their likelihood to move further away from their place of work. Like so many 2020 buyers, they have prioritized the practical use of space and lifestyle over location.

“Within one month of the start of the pandemic, buyers in this age group came out in droves,” said Will Campbell, sales representative at Royal LePage Atlantic in Halifax. “This market is challenging due to a lack of supply. However, young buyers are determined to make a purchase, even if they have to be flexible on location.”

Forty per cent of respondents in Atlantic Canada said their savings have increased since the onset of the pandemic, which is in line with the national average. Seventy-four per cent and 82 per cent of those surveyed in Atlantic Canada feel confident in their short-term and long-term personal financial outlook, respectively.

Campbell noted that first-time buyers are worried they will get priced out of the market if they don’t get in now and take advantage of low interest rates. He expects a brisk spring market with some inventory relief, but likely not enough to satisfy the increasing demand of this cohort.

Royal LePage 2021 Demographic Survey (full national, regional and city-level results): rlp.ca/table_2021demographicsurvey

About Royal LePage

Serving Canadians since 1913, Royal LePage is the country’s leading provider of services to real estate brokerages, with a network of over 18,000 real estate professionals in over 600 locations nationwide. Royal LePage is the only Canadian real estate company to have its own charitable foundation, the Royal LePage Shelter Foundation, dedicated to supporting women’s and children’s shelters and educational programs aimed at ending domestic violence. Royal LePage is a Bridgemarq Real Estate Services Inc. company, a TSX-listed corporation trading under the symbol TSX:BRE. For more information, please visit www.royallepage.ca.

About Leger

An online survey of 2000 Canadians aged 25-35 was completed between December 29, 2020 to January 8, 2021, using Leger’s online panel.

No margin of error can be associated with a non-probability sample (i.e. a web panel in this case). For comparative purposes, though, a probability sample of 2000 respondents would have a margin of error of ±2.2%, 19 times out of 20.

CMHC Says Home Sales Shifting Towards Pricier Housing in Ottawa

CMHC reports that home sales are shifting towards pricier homes in Ottawa. Less than a third of sales were in the under $400,000 price point. Sales between $400,000 and $499,9999 accounted for 22.3 between 2019 and 2020. Homes priced between $700,000 and $799,999 accounted for 7.2 per cent in 2020. Home sales above the $-million mark jumped nearly 30 per cent. Read details in the Ottawa Business Journal post.

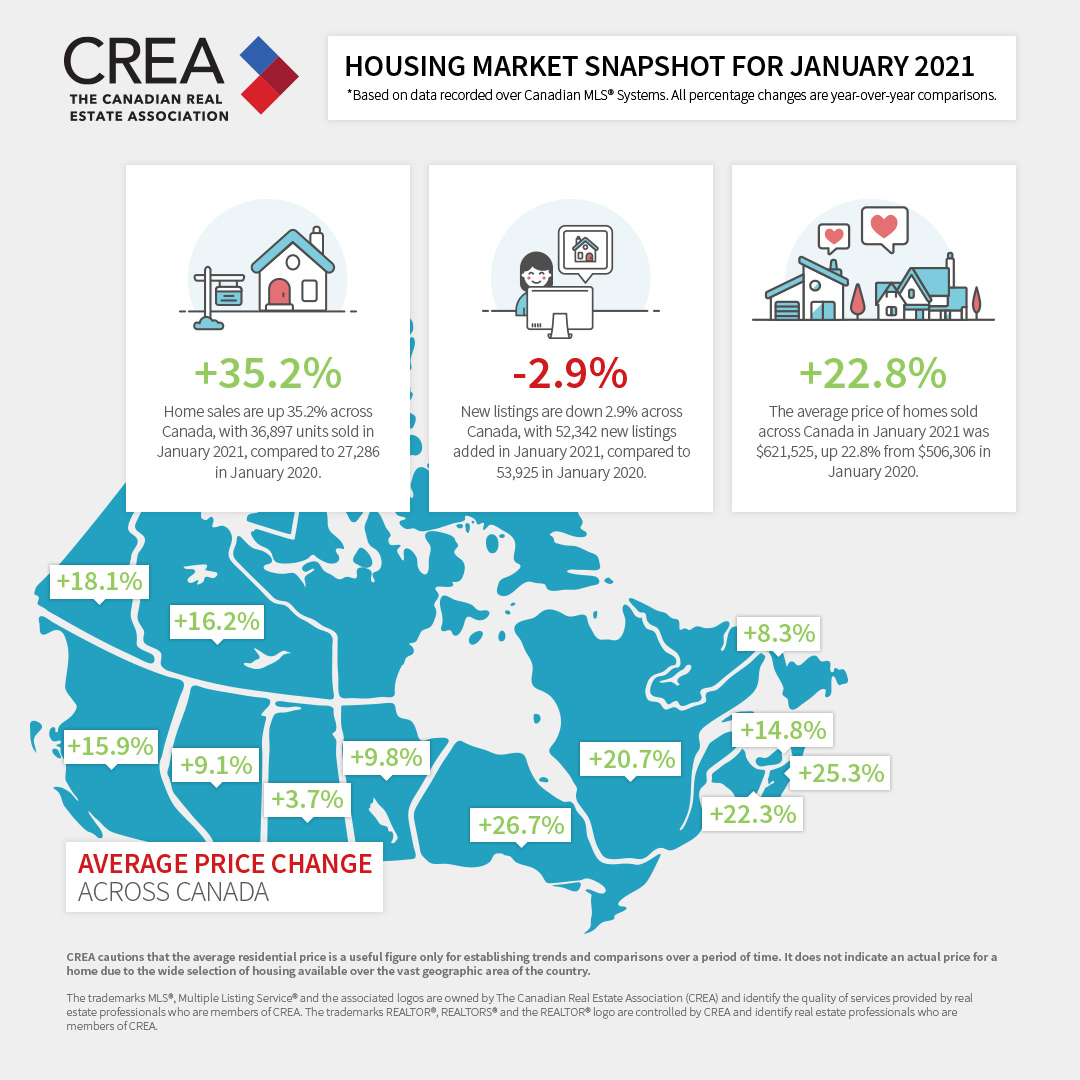

CREA Canadian Real Estate Association) – Canadian Housing Statistics January 2021

Price Ceilings on the Rise in the Ottawa Area Real Estate Market

Average prices up 30 per cent in January. Average residential-class home price $680,000. Inventory down 43 per cent. Details here.

- « Previous Page

- 1

- …

- 29

- 30

- 31

- 32

- 33

- …

- 55

- Next Page »