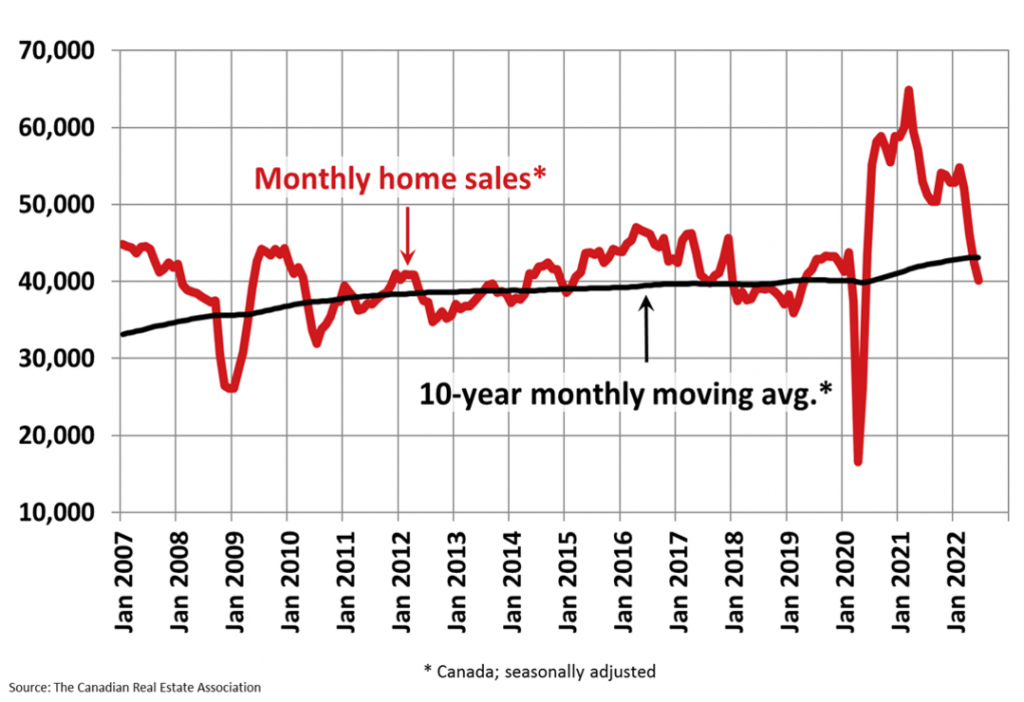

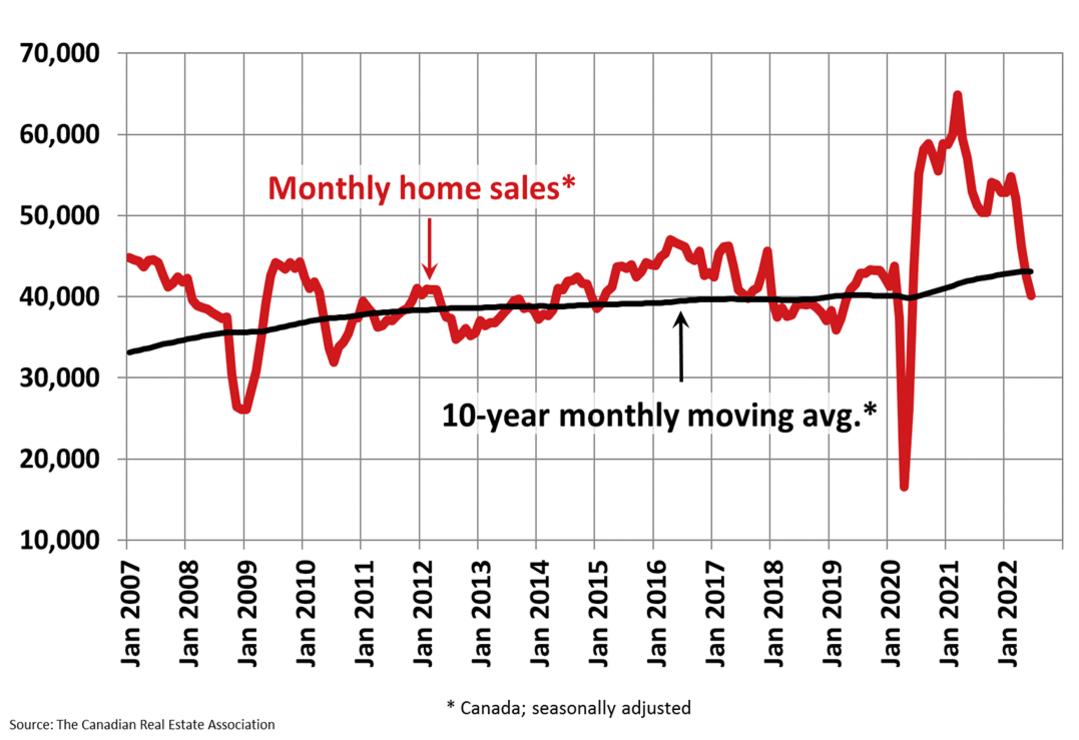

Statistics released by the Canadian Real Estate Association revealed that real estate sales on a national level went up slightly in October.

Highlights of the news release:

- National home sales were up 1.3% on a month-over-month basis in October.

- Actual (not seasonally adjusted) monthly activity came in 36% below October 2021.

- The number of newly listed properties edged up 2.2% month-over-month.

- The MLS® Home Price Index (HPI) declined by 1.2% month-over-month and was down 0.8% year-over-year.

- The actual (not seasonally adjusted) national average sale price posted a 9.9% year-over-year decline in October.