[Read more…]

[Read more…]Royal LePage Market Survey Forecast

Royal Lepage has just released its market survey forecast for 2023. Highlights thereof:

- On a quarter-over-quarter basis, prices expected to flatten in Q2 and begin modest improvement in second half of the year, ending 2023 on upward trajectory; release includes national aggregate quarterly forecast for 2023

- Condominium prices expected to outperform single-family homes in all major markets except Edmonton and Winnipeg

- Greater regions of Toronto and Montreal forecast to see Q4 2023 aggregate price decline of 2.0% year-over-year

- Q4 2023 aggregate home price in Greater Vancouver projected to dip 1.0% year-over-year

- Despite declining affordability, heightened by rising interest rates, continued housing supply shortage acts as a floor on home price declines

- Greater Toronto Area

- Greater Montreal Area

- Greater Vancouver

- Ottawa

- Calgary

- Edmonton

- Halifax

- Winnipeg

- Regina

CREA Canadian Real Estate Association

National Statistics

Canadian home sales edge down from October to November

The Canadian Real Estate Association has recently announced a 3.3 per cent sales decline month-over-month in November. Compared with a year ago, actual home sales in November were down 38.9 per cent compared with November 2021. Details here.

Royal LePage Winter Recreational Property Report

Royal LePage recently released its Winter Recreational Property Report.

The resale price of single-family detached homes in Canada’s most popular regions seemed unaffected by the rising interest rates and what was happening in the residential resale market. It is forecast that this will all change in 2023.

The report which provides a summary of Canada also provides details of the following areas:

- Quebec

- Mont-Tremblant

- Mont Saint-Sauveur

- Val Saint-Côme and Mont Garceau

- Bromont, Sutton

- Stoneham/Lac-Beauport

- Mont-Sainte-Anne

- Ontario

- Southern Georgian Bay

- Alberta

- Canmore

- British Columbia

- Whistler

- Invermere

- Revelstoke

- Mount Washington/Comox Valley

- Sun Peaks

- Big White

Ottawa Real Estate Board (OREB) Comments

CBC.ca, CityNewsEverywhere, and the Sun comment on the latest news release from the Ottawa Real Estate Board (OREB).

Ottawa Real Estate Statistics – November 2022

Ottawa Real Estate Newsletter – December 2022

Ottawa Real Estate News Release (OREB)

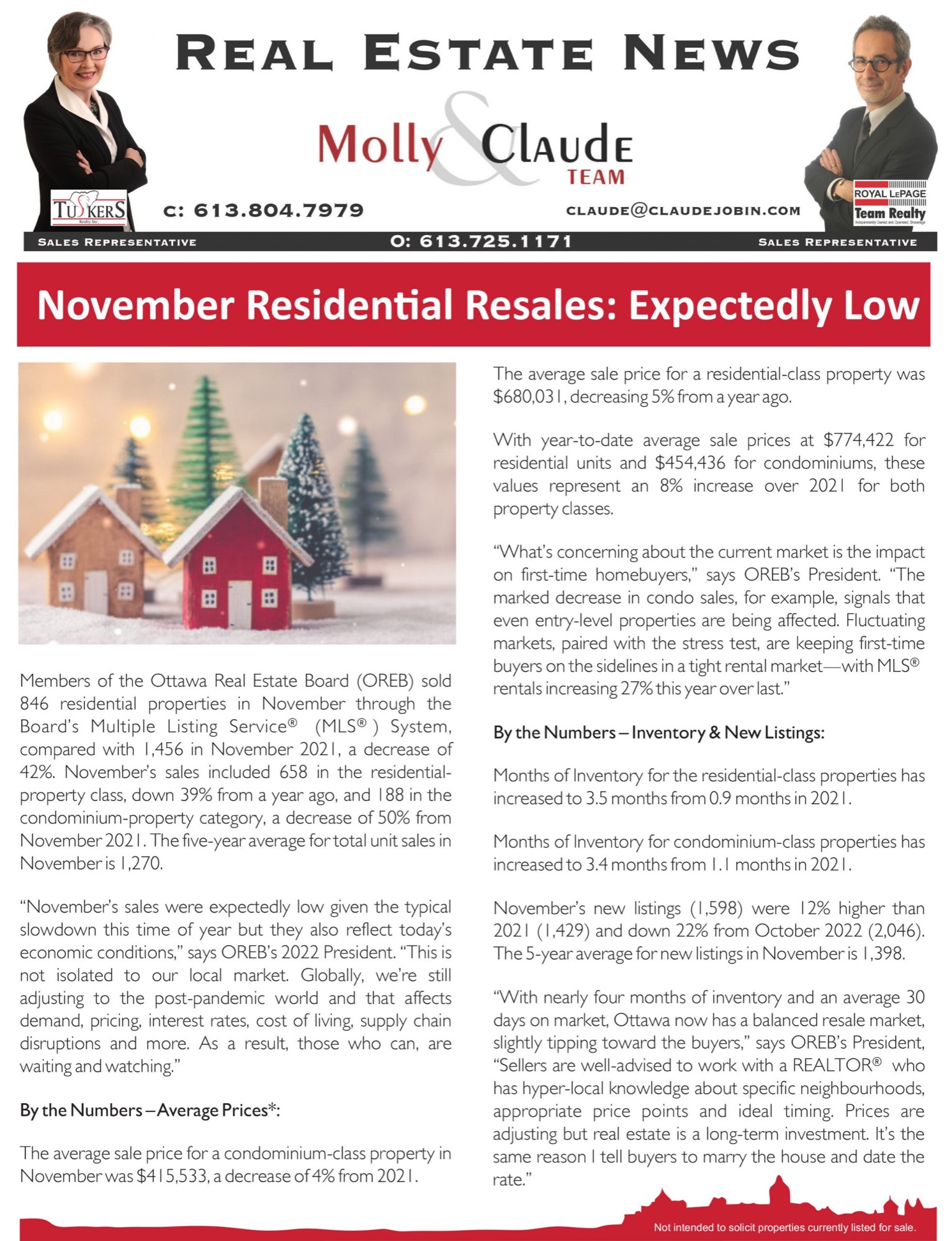

November Residential Resales: Expectedly Low

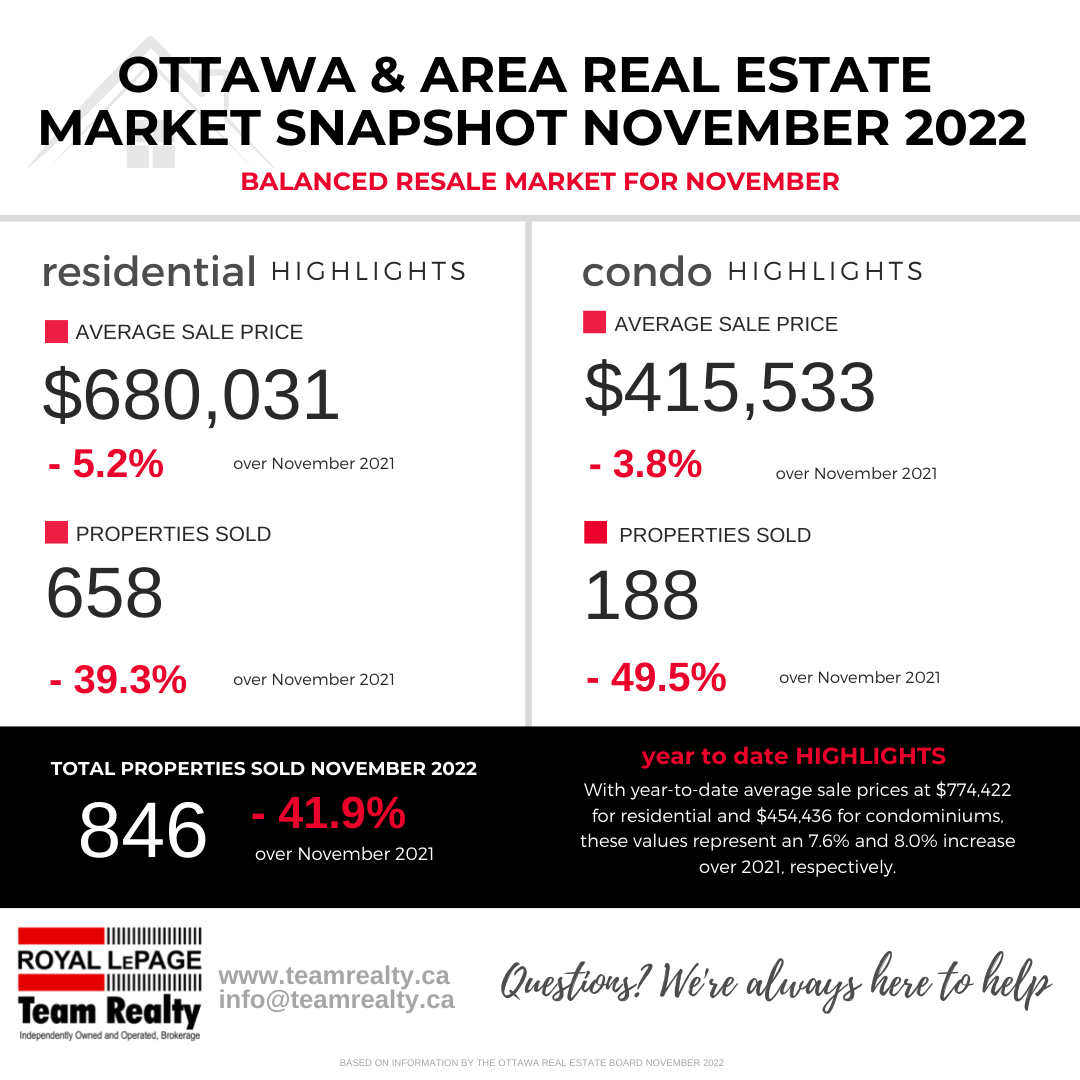

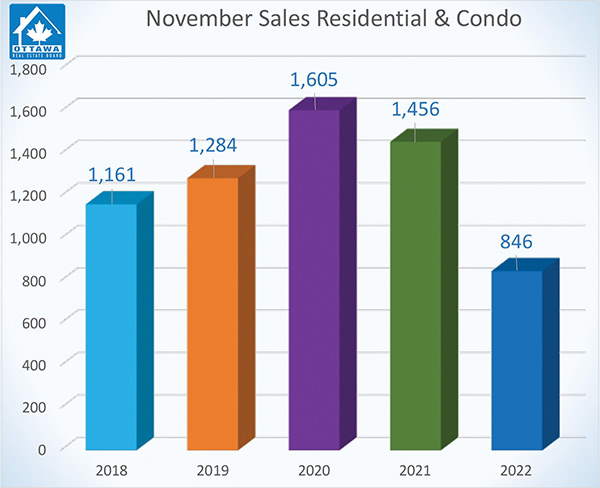

Members of the Ottawa Real Estate Board (OREB) sold 846 residential properties in November through the Board’s Multiple Listing Service® (MLS®) System, compared with 1,456 in November 2021, a decrease of 42%. November’s sales included 658 in the residential-property class, down 39% from a year ago, and 188 in the condominium-property category, a decrease of 50% from November 2021. The five-year average for total unit sales in November is 1,270.

“November’s sales were expectedly low given the typical slowdown this time of year but they also reflect today’s economic conditions,” says Penny Torontow, OREB’s 2022 President. “This is not isolated to our local market. Globally, we’re still adjusting to the post-pandemic world and that affects demand, pricing, interest rates, cost of living, supply chain disruptions and more. As a result, those who can, are waiting and watching.”

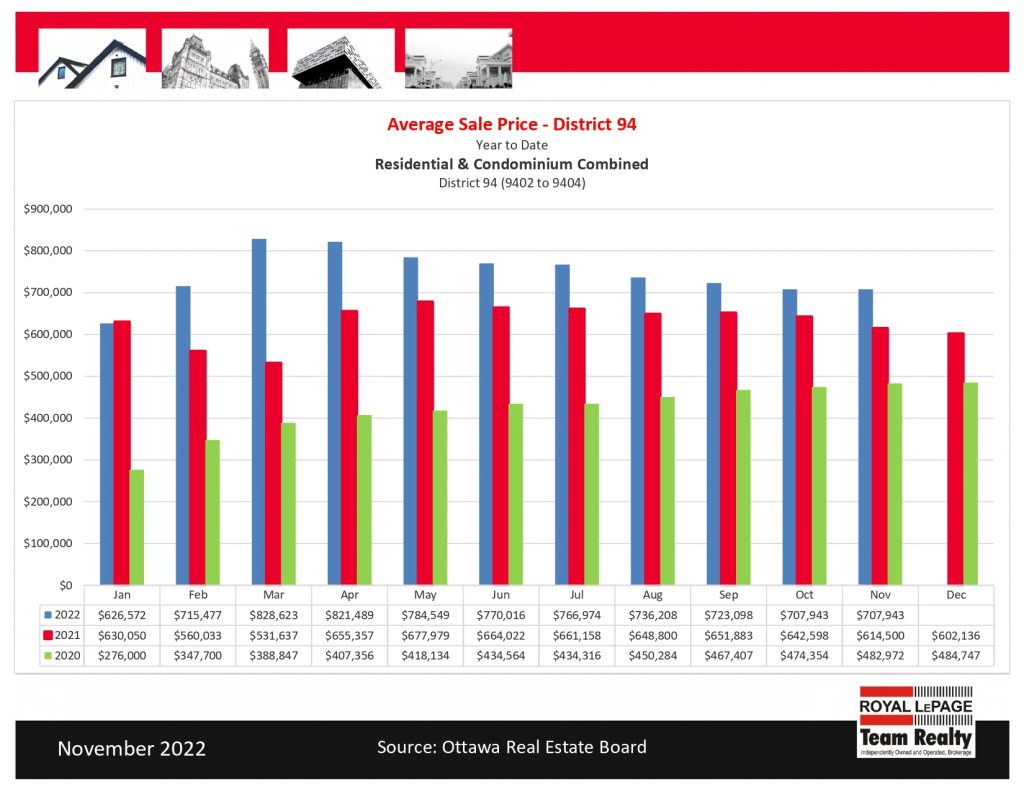

By the Numbers – Average Prices*:

- The average sale price for a condominium-class property in November was $415,533, a decrease of 4% from 2021.

- The average sale price for a residential-class property was $680,031, decreasing 5% from a year ago.

- With year-to-date average sale prices at $774,422 for residential units and $454,436 for condominiums, these values represent an 8% increase over 2021 for both property classes.

By the Numbers – Inventory & New Listings:

- Months of Inventory for the residential-class properties has increased to 3.5 months from 0.9 months in 2021.

- Months of Inventory for condominium-class properties has increased to 3.4 months from 1.1 months in 2021.

- November’s new listings (1,598) were 12% higher than 2021 (1,429) and down 22% from October 2022 (2,046). The 5-year average for new listings in November is 1,398.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

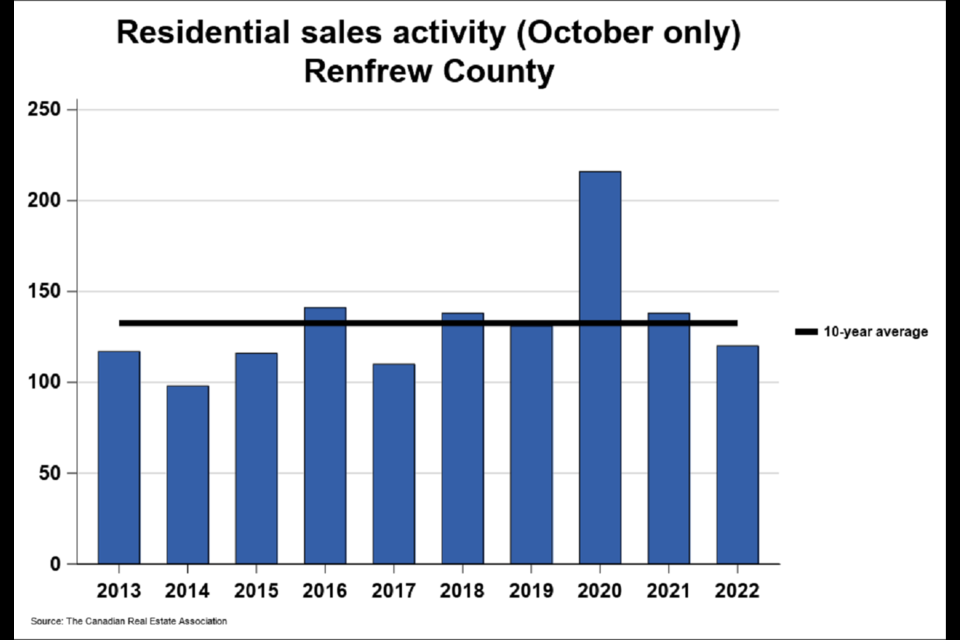

Valley housing sales down again for ninth consecutive month

CityNewsEverywhere reports that real estate sales were down for the 9th consecutive month in October 2022. Sales are down 13 percent in comparison to October 2021. Details here.

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- …

- 55

- Next Page »