[Read more…]

[Read more…]Royal LePage Report – Investment properties

Royal Lepage has recently released it’s report as to the state of investment properties in Canada.

Survey highlights:

- Approximately 4.4 million Canadians currently own an investment property

- 26% of all Canadians say they are likely to buy an investment property within the next five years

- One-third of Canadian real estate investors (32%) own two or more properties

- Younger investors, those aged 18 to 34, are more likely to own more than one investment property compared to their older counterparts (aged 35+)

- 15% of Canadian residential investors do not own their primary residence; the majority of whom are aged 18-34

- Nearly one third of investors in Canada (31%) have considered selling one or more of their investment properties due to higher lending rates

- 20% of investors in the Greater Montreal Area say they are likely to sell one or more of their investment properties within the next two years; this percentage rises to 24% and 28% in the greater regions of Toronto and Vancouver

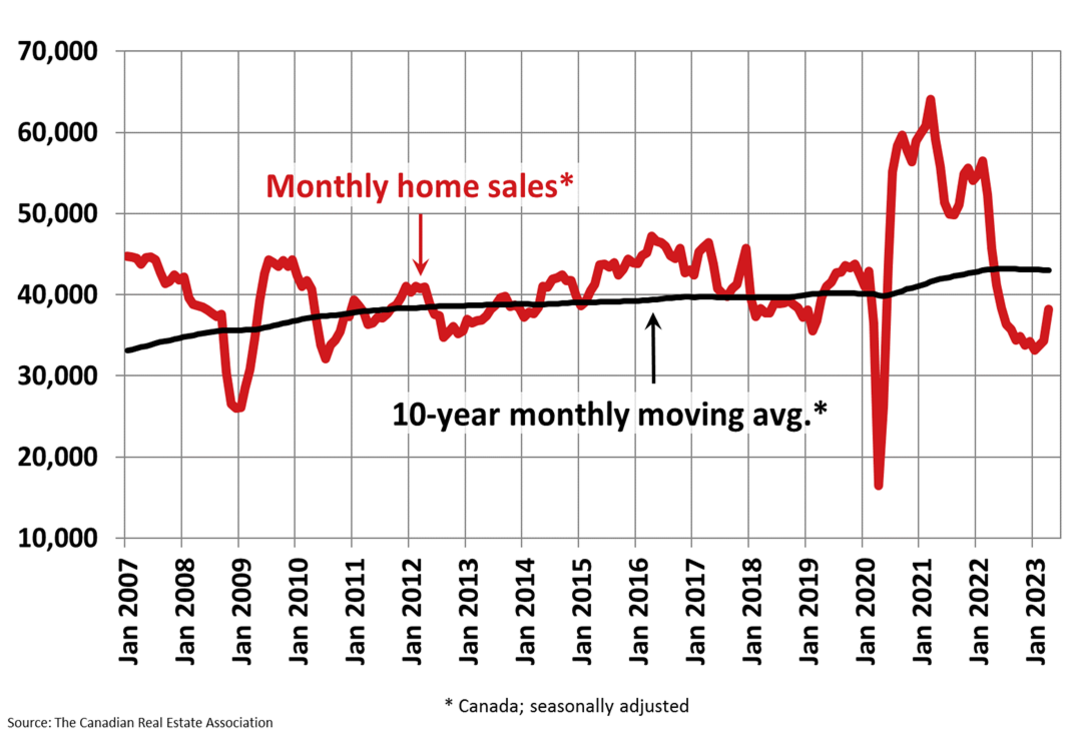

Housing Markets in Canada Have Turned a Corner

CREA (Canadian Real Estate Association) released its national housing statistics for April 2023. Shaun Cathcart, Director and Senior Economist, Housing Data and Market Analysis provides his analysis as to current state of the real estate market.

CREA – Canadian Real Estate Association – Canadian National

The Canadian Real Estate Association has released it’s May 2023 National Statistics. The highlights are.

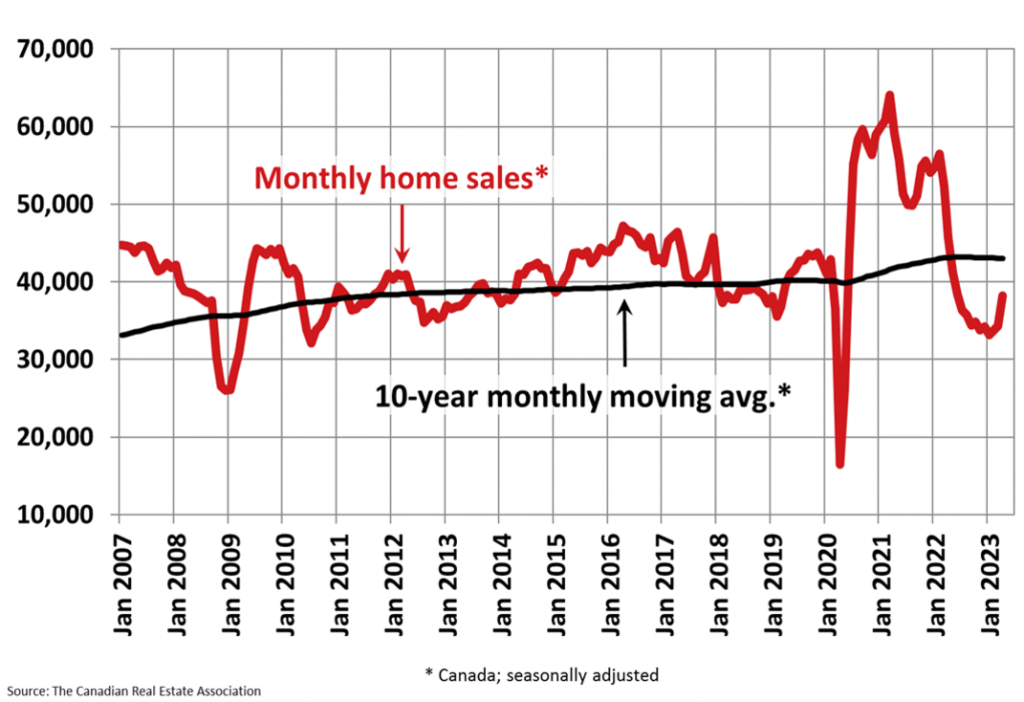

- National home sales surged 11.3% month-over-month in April.

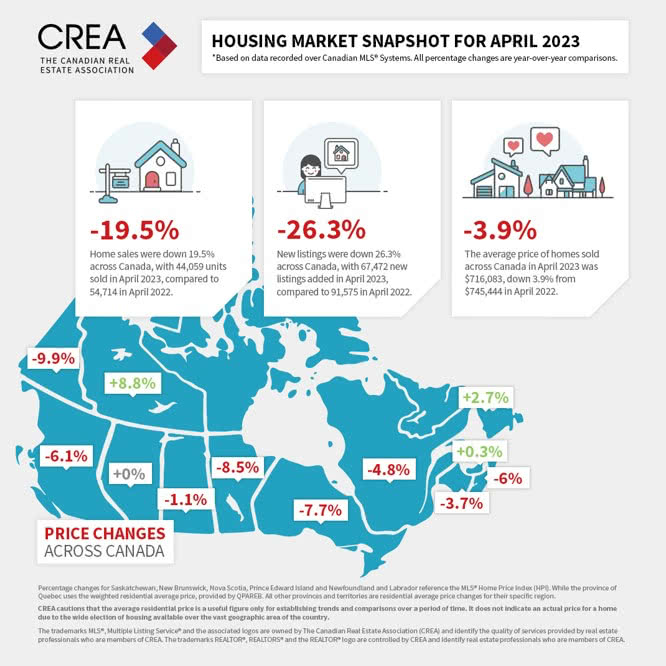

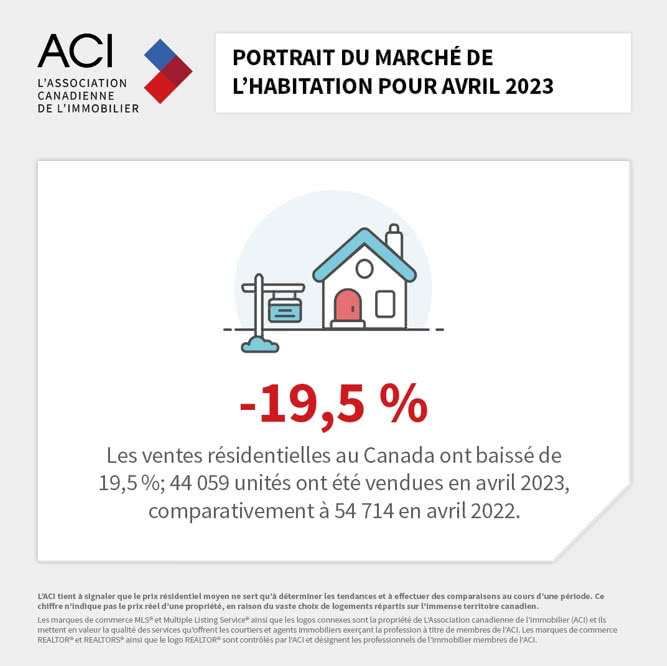

- Actual (not seasonally adjusted) monthly activity came in 19.5% below April 2022.

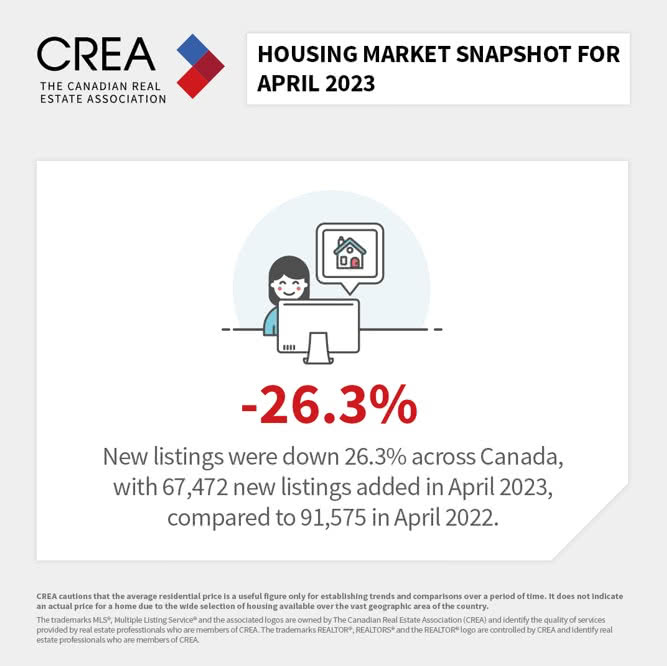

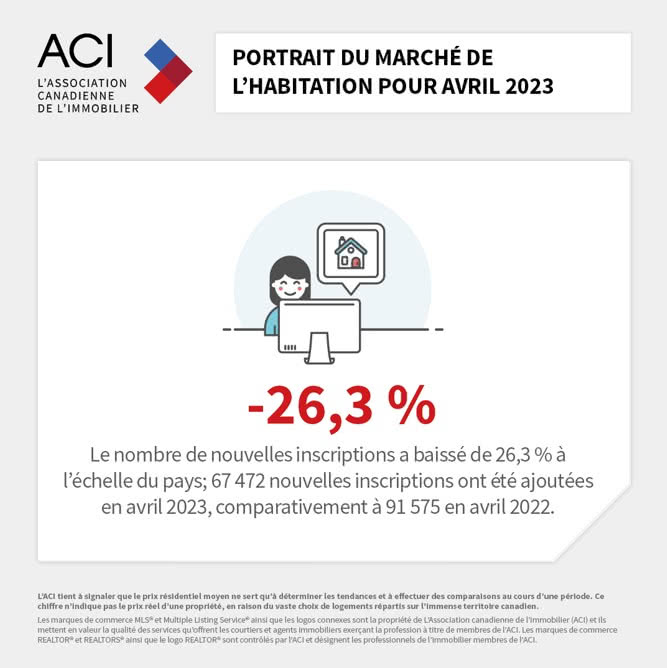

- The number of newly listed properties edged up 1.6% month-over-month but remain at a 20-year low.

- The MLS® Home Price Index (HPI) climbed 1.6% month-over-month but was down 12.3% year-over-year.

- The actual (not seasonally adjusted) national average sale price posted a 3.9% year-over-year decline in April.

CREA (Canadian Real Estate Association) – National Statistics

CREA released its national April 2023 statistics recently.

Highlights are:

- National home sales surged 11.3% month-over-month in April.

- Actual (not seasonally adjusted) monthly activity came in 19.5% below April 2022.

- The number of newly listed properties edged up 1.6% month-over-month but remain at a 20-year low.

- The MLS® Home Price Index (HPI) climbed 1.6% month-over-month but was down 12.3% year-over-year.

- The actual (not seasonally adjusted) national average sale price posted a 3.9% year-over-year decline in April.

Ottawa Real Estate Statistics – April 2023 – Community Stats

Ottawa Real Estate Statistics – April 2023

Ottawa Real Estate News Release (OREB) – Resale Market Springs Back in Favour of Sellers

OTTAWA, May 3, 2023 – Members of the Ottawa Real Estate Board (OREB) sold 1,488 residential properties in April through the Board’s Multiple Listing Service® (MLS®) System, compared with 1,876 in April 2022, a decrease of 21%. April’s sales included 1,156 in the freehold-property class, down 18% from a year ago, and 332 in the condominium-property category, a decrease of 29% from April 2022. The five-year average for total unit sales in April is 1,739.

“Ottawa’s resale market is on a steady upward trajectory, narrowing the comparison gap to peak pandemic activity in 2022. However, with new listings not keeping pace, the available housing stock is declining, and with less than two months of inventory — we’re back into seller’s market territory,” says Ottawa Real Estate Board President Ken Dekker.

By the Numbers – Average Prices*:

- Average prices have increased by 13.9% in four months since the market low in December 2022.

- The average sale price for a freehold-class property in April was $747,123, a decrease of 10% from 2022. However, it marks a 5% increase over March 2023.

- The average sale price for a condominium-class property was $435,875, decreasing 8% from a year ago, but still a 4% gain over March 2023.

- With year-to-date average sale prices at $718,633 for freeholds and $421,722 for condos, these values represent a 13% decrease over 2022 for freehold-class properties and a 10% decrease for condominium-class properties.

By the Numbers – Inventory & New Listings:

- April’s new listings (2,144) were 25% lower than April 2022 (2,843) and up 3% from March 2023 (2,089). The 5-year average for new listings in April is 2,575.

- Months of Inventory for the freehold-class properties has increased to 1.9 months from 0.9 months in April 2022 but down from 2.3 months in March.

- Months of Inventory for condominium-class properties has increased to 1.9 months from 0.8 months in April 2022, although down from 2.1 months in March.

- Days on market (DOM) for freeholds decreased from 34 to 27 days and 39 to 33 days for condos compared to last month.

REALTORS® also help with finding rentals and vetting potential tenants. Since the beginning of the year, OREB Members have assisted clients with renting 2,151 properties compared to 1,786 last year at this time, an increase of 20%.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Buckle Up: Are Housing Markets About to Spring Forward?

Shaun Cathcart, Senior Economist with the Canadian Real Estate Association (CREA) shares his point of view on the spring market subsequent to CREA’s release of the statistics for March 2023.

A team member who keeps an eye on every condo sales in the Ottawa tells me sold prices are closer to the asking price or above. A client tells me as she is surfing she can feel the difference.

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- …

- 55

- Next Page »