Ottawa Real Estate Board Statistics (OREB)

Real Estate Newsletter

August 2017

Condominium Management Regulatory Authority of Ontario

New regulations and the creation of the Condominium Management Regulatory Authority of Ontario will further enhance the structure of condominium corporations for their owners. These changes have been announced by the Government of Ontario. You may read more in this article in Ottawa Metro and in this article on cbc.ca

Home Affordability

The National bank of Canada’s second quarter housing affordability monitor is showing Ottawa with an improved home affordability at -0.6.

Other Canadian cities that have also seen their affordability improve are: Montreal, Quebec City, Calgary, Edmonton, and Winnipeg. Toronto and Vancouver you wont be too surprised to read their affordability had deteriorated.

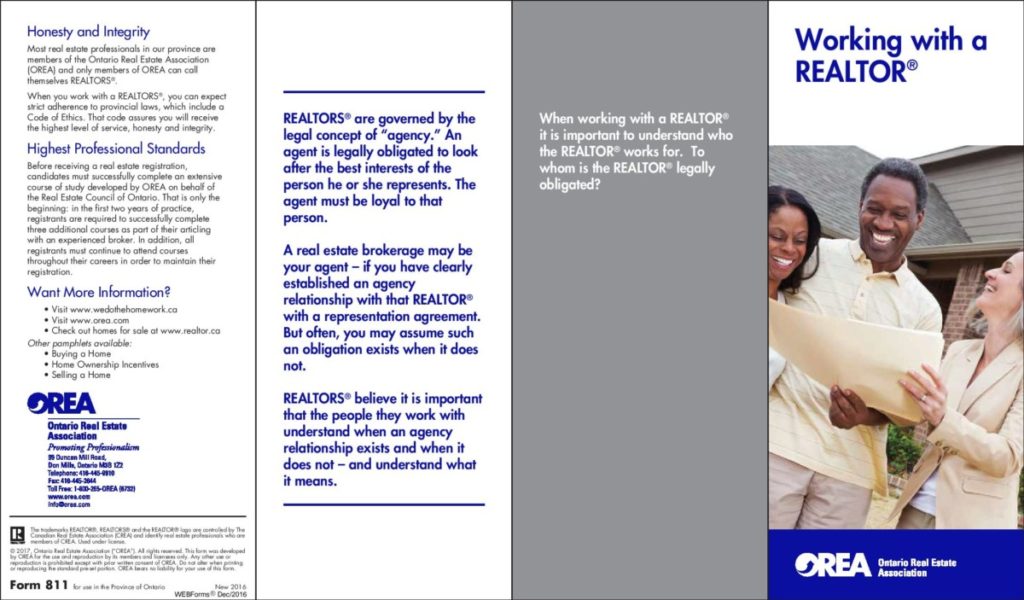

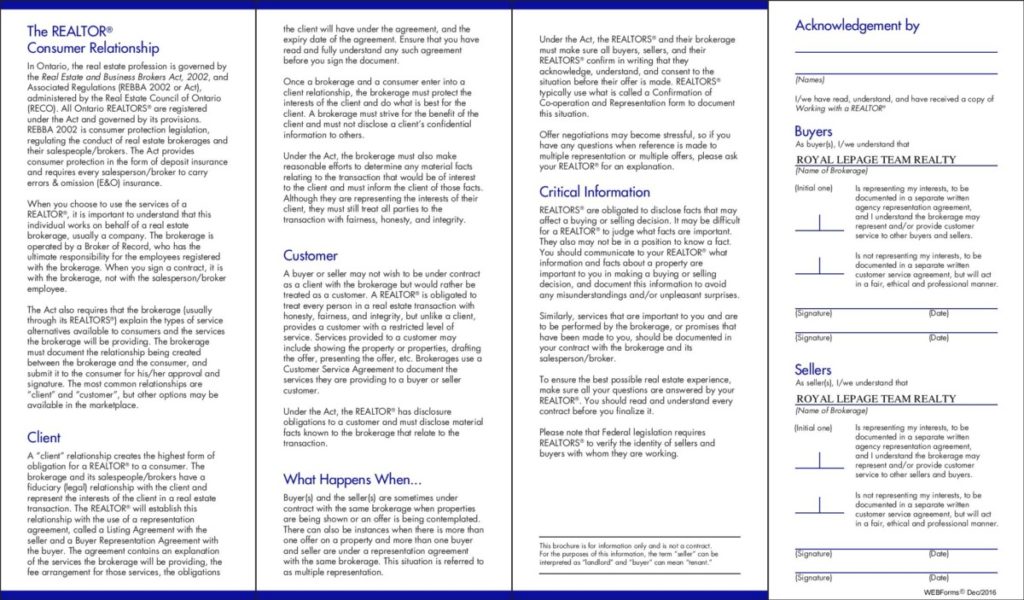

Working with a Realtor

Below you will find an electronic version of the pamphlet Working with a Realtor as well as a form version of said pamphlet. It’s a good read to better understand the distinction between client and customer in real estate as well as what is owed which. Molly and I prefer to work in a client relationship with our buyers as it creates a relationship of representation providing advise with regards their purchase. But sometimes we find ourselves in a customer relationship and that can be an option.

CREA – Canadian Real Estate Association Statistics

You may have read it on CBC.ca CREA the Canadian Real Estate Real Estate Association have released their June Statistics today. It’s never my favourite day of the month. The problem is the numbers do jump out and can startle. The Canadian numbers are affected by the sureal cities of Vancouver and Toronto and the Ontario numbers are affected by Toronto. So for Ottawa news refer back to the Ottawa Real Estate Board (OREB) Statistics for detailed statistics or to my Newsletter for a summary of the information. Highlights thereof in Ottawa there were 2300 unit sales in May and 2162 in June so yes a slight decrease. Average sale price residential & condo combined was $395,135 in May and $398,010 in June also up.

Prevent a Power of Sale By Selling Your House

Mortgage lenders in Ontario are able to use the power of sale process to recover their mortgage investment by selling the mortgaged property. Lenders are legally permitted to put the homeowner in power of sale if the homeowner misses any mortgage payments, or breaks any other terms of the mortgage. The power of sale takes around 3 to 4 months to complete and ends with the homeowner being evicted and having their property sold. In Ontario a power of sale is preferred over foreclosure as it is the most efficient way for a lender to recoup their investment. In foreclosure, the lender takes ownership of the property but in power of sale the lender simply has the right to sell the property. The foreclosure process can take over a year but when the lender takes title to the property they take all the equity in it. With a power of sale, the former homeowner receives all the money left over after the sale of the property. Since the fees involved in power of sale are usually quite high, there typically is very little money left for the homeowner.

If you are currently in power of sale or expect to be in power of sale, acting quickly can help you save money. Each document related to the power of sale costs money to be written and delivered. These costs are passed on to the homeowner and deducted from the money produced by the sale of the home. This means that if you can stop the power of sale upon receiving the initial notice, you will incur minimal charges. There are several diffident ways to stop the power of sale process. If you have enough equity in your home, it may be possible to get a second mortgage and bring the problem mortgage back into good standing. Another way to stop the power of sale is to replace the problem mortgage with an entirely new mortgage. There are many private mortgage lenders that will lend to people in power of sale regardless of income or credit scores.

If getting a new mortgage is not an option, then the next best option is to sell the home yourself. Once your home is put up for sale, most mortgage lenders will stop their power of sale proceedings and allow the sale to complete. Once the house is sold, the mortgage is paid out and the power of sale proceedings are stopped immediately. Selling the home yourself also allows you more time to move out your belongings and find another place to live. When the homeowner sells their home, the final sales price is typically higher and the fees related to the power of sale are much lower. If you or a loved one need help to deal with a power of sale you can contact Ron Alphonso. Ron is the principal broker at Mortgage Broker Store and he specialises in stopping power of sales and foreclosures. You can reach Ron directly at 416-499-2122 or by email at ron@mortgagebrokerstore.com.

“Ottawa Housing Train is Leaving the Station”

In this article BMO Bank of Montreal suggests that after 5 years of stagnation the Ottawa real estate market is poised to get heated up.

BMO quotes MoneySense ranking Ottawa as “Canada’s best place to live”.

Neighbours!

No mater how far or how close – and it’s generally how closes, having a good rapport with the neighbours can really make a difference to your life. Here a good article from the Ottawa Citizen which highlights a few things to keep in mind to keep things running smoothly.

- « Previous Page

- 1

- …

- 64

- 65

- 66

- 67

- 68

- …

- 76

- Next Page »