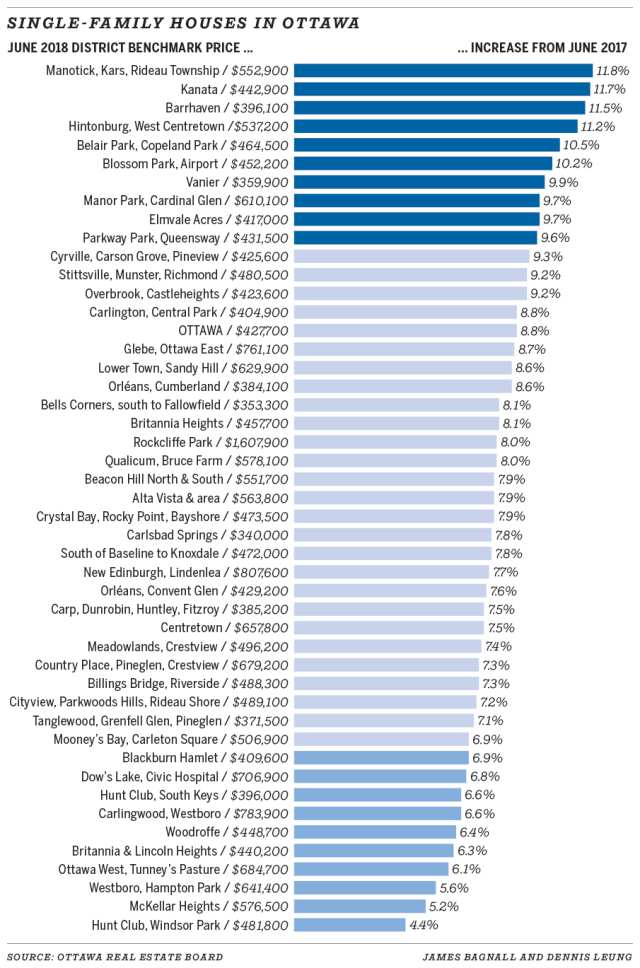

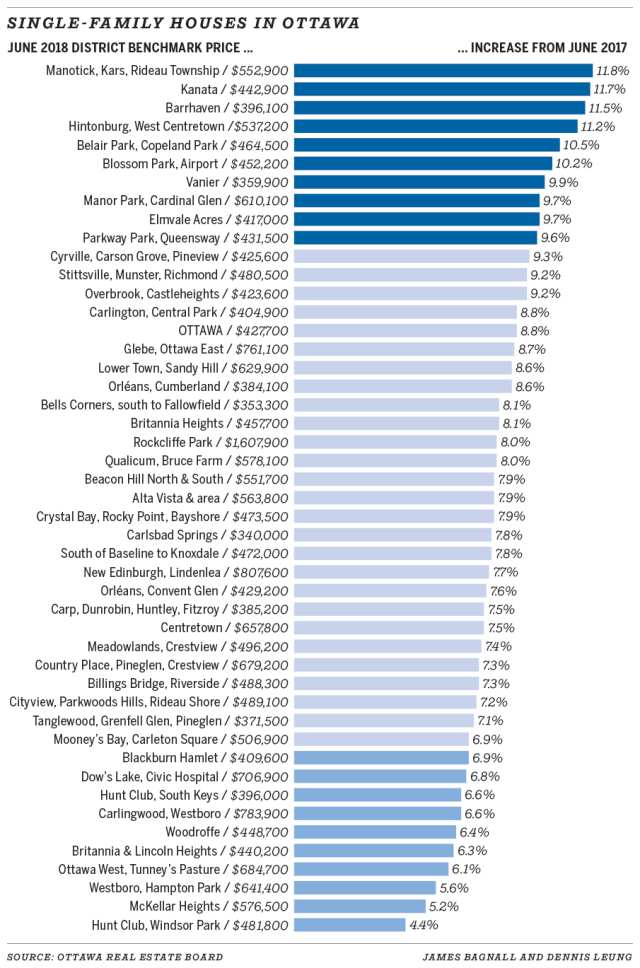

CREA has released the June 2018 statistics. A snapshot of the information can be found on the REP website. The details on the CREA website.

The Molly & Claude Team Realtors Ottawa, Royal LePageTeam Realty

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin

by Claude Jobin