[Read more…]

[Read more…]Ottawa Real Estate Board (OREB)

Latest News Release

October’s Whirlwind Resale Market

OTTAWA, November 5, 2019 – Members of the Ottawa Real Estate Board sold 1,607 residential properties in October through the Board’s Multiple Listing Service® System, compared with 1,375 in October 2018, an increase of 16.9 per cent. October’s sales included 1,211 in the residential-property class, up 15 per cent from a year ago, and 396 in the condominium-property category, an increase of 23 per cent from October 2018. The five-year average for October unit sales is 1,319.

“New listings are down, inventory remains scarce, and yet more homes changed hands this October than in the past decade and a half,” reports Dwight Delahunt, President of the Ottawa Real Estate Board. “It’s perplexing at first; however, when you consider the current breakneck transaction pace in the Ottawa resale market, often requiring homebuyers and sellers to make swift decisions, it makes sense.”

“October’s average Days on Market (DOM) for residential properties decreased by 10 days to 33 days, and the DOM for condominiums decreased to 28 days from the average 47 days experienced this time last year. Year to date figures show 31 DOM (down 8 days) for residential properties and 35 DOM (16 fewer days) for condominiums. Products are flying off the shelves, so to speak.”

October’s average sale price for a condominium-class property was $319,208, an increase of 18.3 per cent from last year while the average sale price of a residential-class property was $483,405, an increase of 7.6 per cent from a year ago. Year to date figures show an 8.3 per cent and 9.1 per cent increase in average sale prices for residential and condominiums, respectively.*

“We are seeing slightly above-average climbs in home prices this year, and the equity in many properties is undoubtedly increasing, which is great news for homeowners. Still, the growths are reasonable considering the state of the market and Ottawa retains its reputation of being one of the country’s most affordable cities where residents can enjoy a high quality of life,” Delahunt acknowledges.

The most active price range in the condominium market was $225,000-$349,999, accounting for 53 per cent of the units sold while $350,000 to $499,999 represented the most prevalent price point in the residential market, accounting for 43 per cent of October’s transactions. Residential properties in the $500,000 to $749,999 range increased to 30 per cent of all residential resales.

“We are noticing a significant uptick in residential properties sold in the $500-750K price range. This price point now represents almost 1 in every 3 home sales.”

“Even though there are incidences of multiple offers and homes sold for over market value, the reality is that approximately 36% of homes are selling over asking, compared to 21% at this time last year. It is a phenomenon that is affecting specific pockets of the city, but certainly not every neighbourhood or property type.”

“Sellers should use the knowledge of a REALTOR® to understand the complexities of their home’s positioning. Buyers require timely guidance on how to put in an attractive offer in this fast-paced market — and both parties must understand the intricacies of the contracts they are signing,” Delahunt advises.

In addition to residential sales, OREB Members assisted clients with renting 2,334 properties since the beginning of the year.

Ottawa Homebuilding Growth

CMHC predicts Ottawa should see healthy homebuilding growth in the coming years. This article within the Ottawa Business Journal forecasts the coming years and compares to past years.

Canadian Housing Health

Interesting article presenting the effect of the Canadian economy on purchasers and thus the real estate market.

Ottawa Office Market Activity / Federal Election

Leasing activity in office buildings downtown reported being steady in the last quarter. The upcoming federal elections may change that. Details in this article by Ottawa Business Journal.

Real Estate Update by Phil Soper CEO Royal LePage Canada

Phil Soper CEO of Royal Lepage talks about the real estate market in the third quarter of 2019. Should you be curious about trends in other areas of the country click here for Royal Lepage Regional Market Summaries.

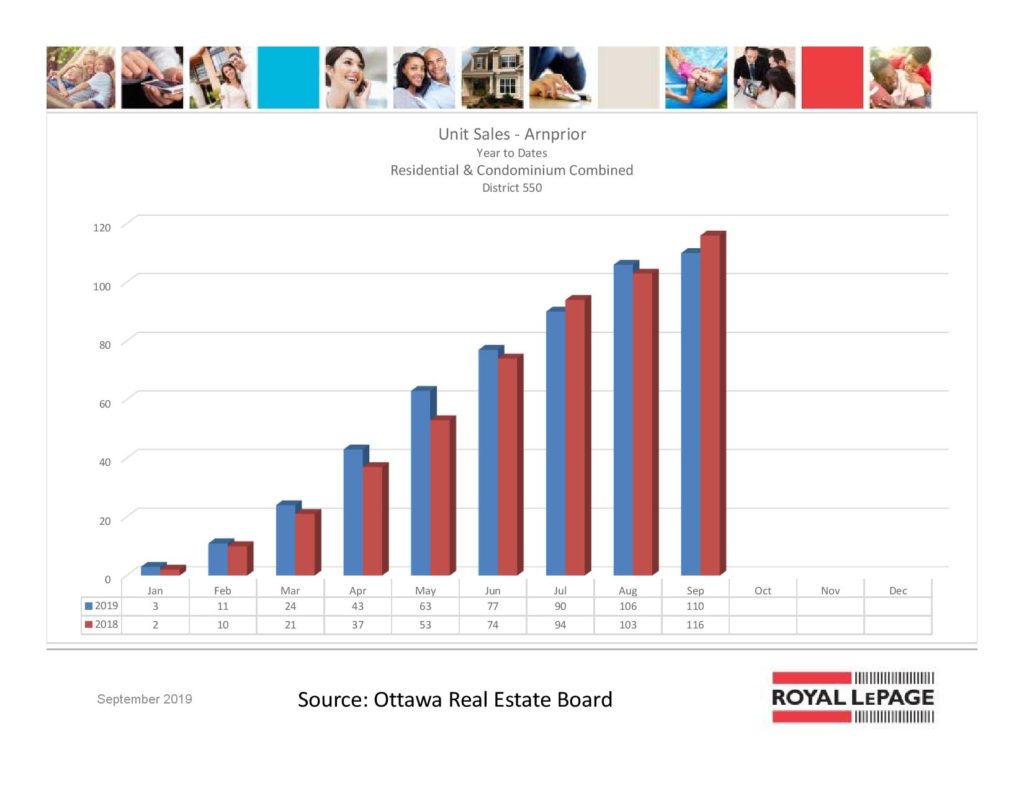

OREB – Ottawa Real Estate Board Statistics – September 2019

Ottawa Real Estate Newsletter – October 2019

Ottawa Real Estate Board (OREB)

Latest News Release

Fall Market Springs Forward

OTTAWA, October 3, 2019 – Members of the Ottawa Real Estate Board sold 1,549 residential properties in September through the Board’s Multiple Listing Service® System, compared with 1,386 in September 2018, an increase of 11.8 per cent. September’s sales included 1,113 in the residential-property class, up 6.9 per cent from a year ago, and 436 in the condominium-property category, an increase of 26.4 per cent from September 2018. The five-year average for September unit sales is 1,385.

“Despite a challenging year of historically low inventory, September’s sales continue to be extremely strong, the likes of which we haven’t seen in the past 15 years,” acknowledges Dwight Delahunt, President of the Ottawa Real Estate Board. “It’s quite amazing, with the limited supply, that the market is still moving well with purchasers finding properties that meet their requirements,” he adds.

“Of course, in this kind of market where the process can be quite accelerated, you must be ready to make a decision quickly and be poised to act straightaway. That’s why it’s prudent to work with a REALTOR® — home sellers can expose their properties immediately, and buyers are able to have instant access to the latest listings posted to the MLS® System,” Delahunt advises.

September’s average sale price for a condominium-class property was $309,373, an increase of 9 per cent from last year while the average sale price of a residential-class property was $487,438, an increase of 8 per cent from a year ago. Year to date figures show an 8.4 per cent and 8.1 per cent increase in average sale prices for residential and condominiums respectively. *

“Now that condominium prices have recovered, we see condo sellers jumping back into the market to take advantage of that, and as a result, condo sales have been very robust and have again led the way in September’s unit sales,” Delahunt suggests.

The $350,000 to $499,999 price range was the most prevalent price point in the residential market, accounting for 43.5 per cent of September’s transactions while 28 per cent of residential sales were in the $500,000 to $749,999 range. The most active price point in the condominium was $225,000-$349,999, accounting for 56 per cent of the units sold.

“September to November typically tend to be busy listing and sales months; however, there is a federal election coming up, which normally brings a slowdown in the market. We haven’t seen that transpire this year, which suggests that consumers are highly confident in our local economy and the Ottawa real estate market.”

When asked to elaborate on the pressing issue of housing in the upcoming election, Delahunt states, “We are closely monitoring the platforms of all parties, and any proposals that address supply certainly have our support.”

He continues, “Although Canada needs a broad-based national housing strategy which tackles the full range of housing issues, platforms that are getting it right understand that real estate is local, and policies must factor in regional differences.”

In addition to residential sales, OREB Members assisted clients with renting 2,117 properties since the beginning of the year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

- « Previous Page

- 1

- …

- 52

- 53

- 54

- 55

- 56

- …

- 77

- Next Page »