[Read more…]

[Read more…]Ottawa Real Estate Statistics

First-time home buyers

I changed the title of this article featured in the sun from “what do you do if you can’t rely on family money to buy your first home“. In my mind the Sun loves shocking headlines. But in reality perhaps that is how the article needs to be titled. I didn’t realize the figure for relying on help from family money was so high: 30% for first-time buyers and 10% for others. In this article, Phil Soper, President of Royal LePage highlights alternatives to get you started. Some ideas better than others – or perhaps more suitable for some than others. But sometimes creativity is needed!

New housing construction in Ottawa hit 50-year high in 2021: CMHC

The Canada Mortgage and Housing Corporation (CMHC) reports that there was a housing boom in the housing market in 2021. Read more here on CTV News.

A new ‘normal’ glimpsed in Ottawa real estate as April home sales drop, listings increase

Rick Eisert, broker/manager of Royal LePage Team Realty, provides the Ottawa Citizen with insight on the recently issued Ottawa Real Estate Board (OREB) news release. Click here for the complete news release and here for the Molly & Claude team newsletter. Detailed area statistics will be shortly available, when they are, circle back to this link.

Ottawa Real Estate Statistics

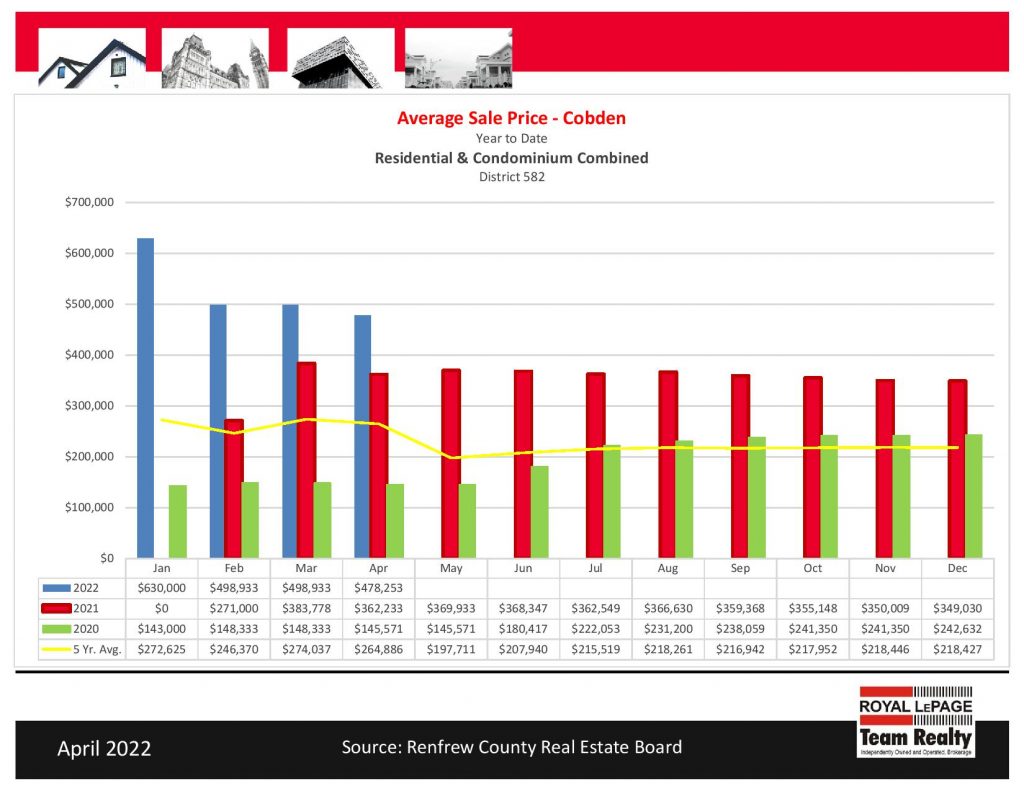

April 2022

Ottawa Real Estate Newsletter – May 2022

Ottawa Real Estate News Release (OREB)

April Residential Resales in a Flux

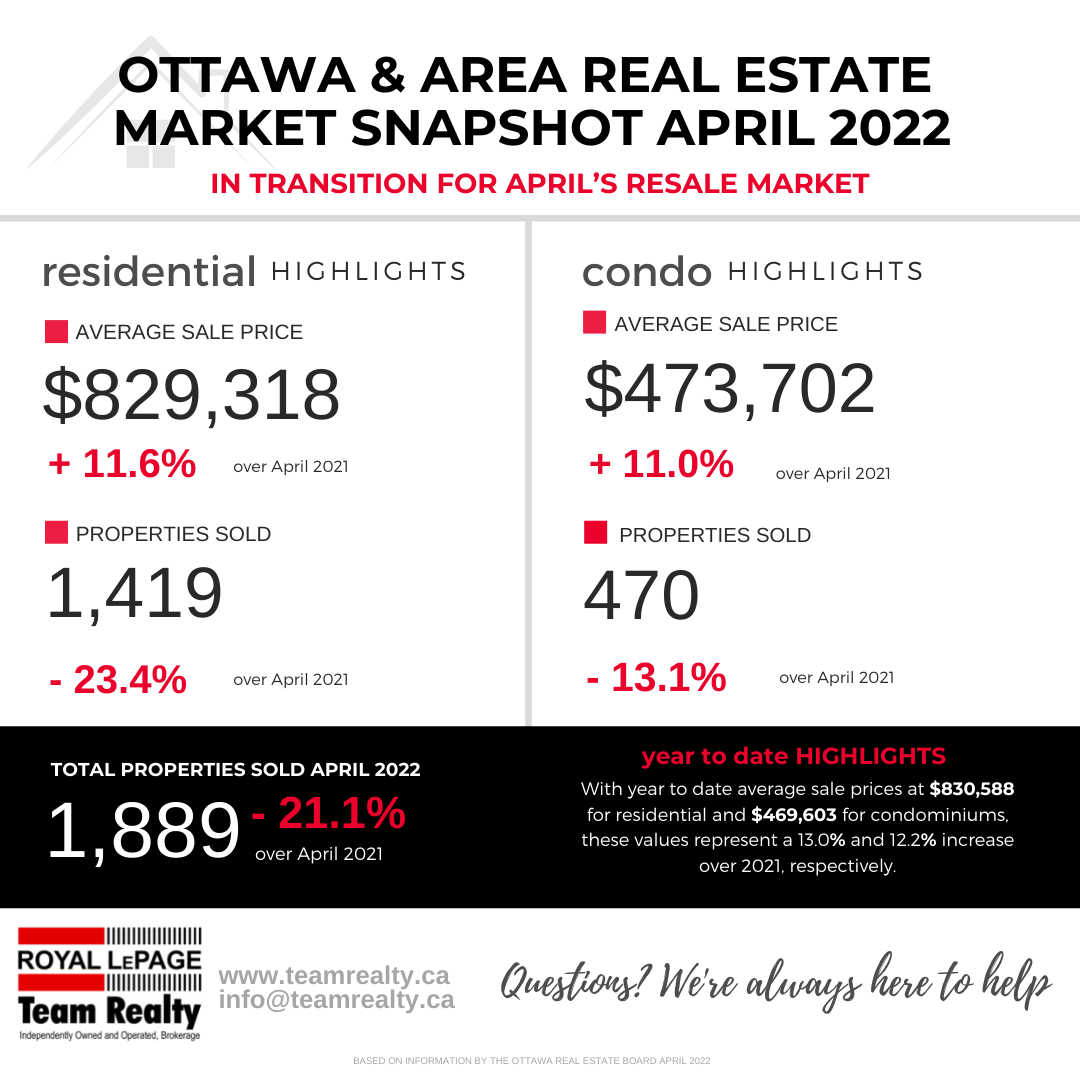

OTTAWA, May 4, 2022 – Members of the Ottawa Real Estate Board sold 1,889 residential properties in April through the Board’s Multiple Listing Service® System, compared with 2,394 in April 2021, a decrease of 21 per cent. April’s sales included 1,419 in the residential-property class, down 23 per cent from a year ago, and 470 in the condominium-property category, a decrease of 13 per cent from April 2021. The five-year average for total unit sales in April is 1,849.

“With the number of transactions just slightly over the 5-year average, this was one of the weakest performing Aprils we have seen in a while,” states Ottawa Real Estate Board’s President Penny Torontow. “Considering that the number of new listings increased last month, it is a bit of a surprise that sales were off.”

“Certainly, there are a few factors at play: rising interest rates, growing Buyer frustration, April’s cooler temperatures, as well as the housing supply measures recently announced by the government – these could all be causing Buyers to pull back with a wait-and-see approach. We are watching the rest of the spring market closely to determine if this could perhaps be an early indicator of a shift in the market. Since April is only one month, we will be monitoring to see if it becomes a trend moving forward.”

“The fact remains that it is still a Seller’s market with supply under one month. Bidding wars and multiple offers persist in some pockets, prices continue to rise, albeit more moderately, and the market remains relatively strong,” she adds.

The average sale price for a condominium-class property in April was $473,702, an increase of 11 per cent from 2021, while the average sale price for a residential-class property was $829,318, increasing 12 per cent from a year ago. With year-to-date average sale prices at $830,588 for residential and $469,603 for condominiums, these values represent a 13 per cent and 12 percent increase over 2021, respectively.*

“Limited supply and high demand will continue to place upward pressure on prices. And as long as there are Buyers willing to pay, average prices will reflect the inventory shortage. However, it is conceivable that price growth may moderate as we do not see the level of price escalations that occurred earlier in the pandemic,” Torontow suggests.

“Although the number of new listings in April (2,846) was down by 11% from 2021, the number of properties that entered the market was still 10% over the 5-year average (2,600), and 214 units more than what was added to the housing stock in March. This has increased Ottawa’s months of inventory to just under a month’s supply. In March, it was just over two weeks. This is good news for potential Buyers as they will have more options and more opportunities to enter the market.”

“In fact, the condominium market may be performing slightly better than residential property classes due to the fact that they are the most affordable price point to enter the market and could possibly now be considered the new entry-level property type.”

“We have also noticed a marked increase in the number of rental properties listed on the MLS® System. Since the beginning of the year, OREB Members assisted clients with renting 1,786 properties compared to 1,458 last year at this time. An increase of 23% and almost double the quantity recorded in pre-pandemic years. As for lease prices, the average cost for a 1-bdrm is approximately $1,850, and a 2-bdrm is $2,200 for rentals listed on the MLS® System. These values are roughly 3-4% higher than this time in 2021. Ottawa REALTORS® are an excellent resource when it comes to finding a rental property or vetting tenants – contact one today!”

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Why even falling prices won’t make housing affordable any time soon

An interesting article by Peter Armstrong, Senior Business reporter for CBC News which goes into detail as to why falling prices won’t make housing more affordable.

Q&A: Senior Economist Answers Common Real Estate Questions

Shaun Cathcart a Senior Economist and Director of Housing Date and Market Analysis at the Canadian Real Estate Association (CREA) delves into the following real estate questions:

- What are the factors that cause the housing market to react? Is it the economy, COVID-19, buyer behaviour, or a combination?

- The stress test for uninsured mortgages remains the same for now. What are Canada’s other current mortgage qualifications that buyers and sellers should know about?

- Inflation is expected to be high in 2022. What impacts will this have on the housing market and mortgage rates?

- Real estate prices have continued to rise. How much higher could they go in 2022, and what would it take for growth to level off?

- How are national home buying policies, such as the stress test, influenced by the trends in leading markets such as Vancouver and Toronto?

- If I’m a buyer or seller in 2022, what can I expect when the spring market comes around? When does that period typically start?

- Is there potential for traditionally smaller markets to surge in 2022 due to peoples’ mindsets and desires around housing changing?

- « Previous Page

- 1

- …

- 27

- 28

- 29

- 30

- 31

- …

- 76

- Next Page »