OTTAWA, July 6, 2022 –

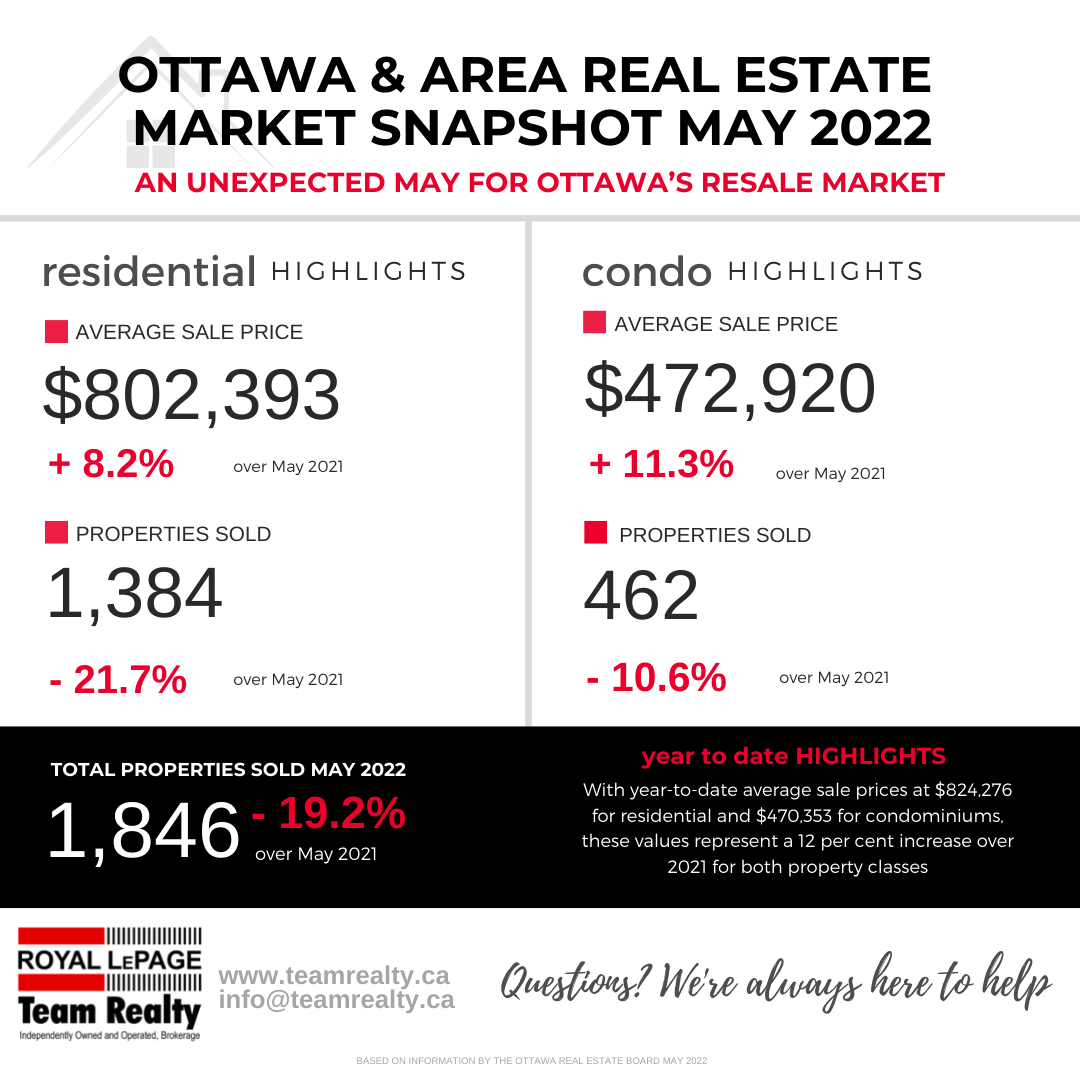

Members of the Ottawa Real Estate Board sold 1,508 residential properties in June through the Board’s Multiple Listing Service® System, compared with 2,122 in June 2021, a decrease of 29 per cent. June’s sales included 1,138 in the residential-property class, down 31 per cent from a year ago, and 370 in the condominium-property category, a decrease of 23 per cent from June 2021. The five-year average for total unit sales in June is 1,966.

“After the frenzy of the past two years, we are witnessing Ottawa’s resale market normalize in 2022 and shift towards the more traditional seasonal ebb and flow cycle. While June transactions do typically taper as many look towards their summer holidays, last month’s sales were at a slower pace than we have seen in well over a decade,” states Ottawa Real Estate Board President Penny Torontow.

“We can likely attribute the decrease in unit sales to economic factors such as rising interest rates and cost of living/inflation. Other dynamics could include Buyer fatigue combined with a wait-and-see approach towards home prices, lack of confidence amongst consumers, and perhaps the uncertainty surrounding back-to-work arrangements as a long commute with rocketing gas prices will certainly affect decisions about where to live,” she adds.

The average sale price for a condominium-class property in June was $438,977, an increase of 1 per cent from 2021, while the average sale price for a residential-class property was $772,861, increasing 6 per cent from a year ago. With year-to-date average sale prices at $815,797 for residential and $465,573 for condominiums, these values represent an 11 per cent and 10 percent increase over 2021, respectively.*

“It’s no secret that price increases have become more modest in the last two months–there’s a new benchmark reality in Ottawa. While our average price statistics provide an overall picture, as the market settles, there will be adjustment differences in various pockets of the city. For example, what happens in Westboro will not likely mirror Findlay Creek,” advises Torontow.

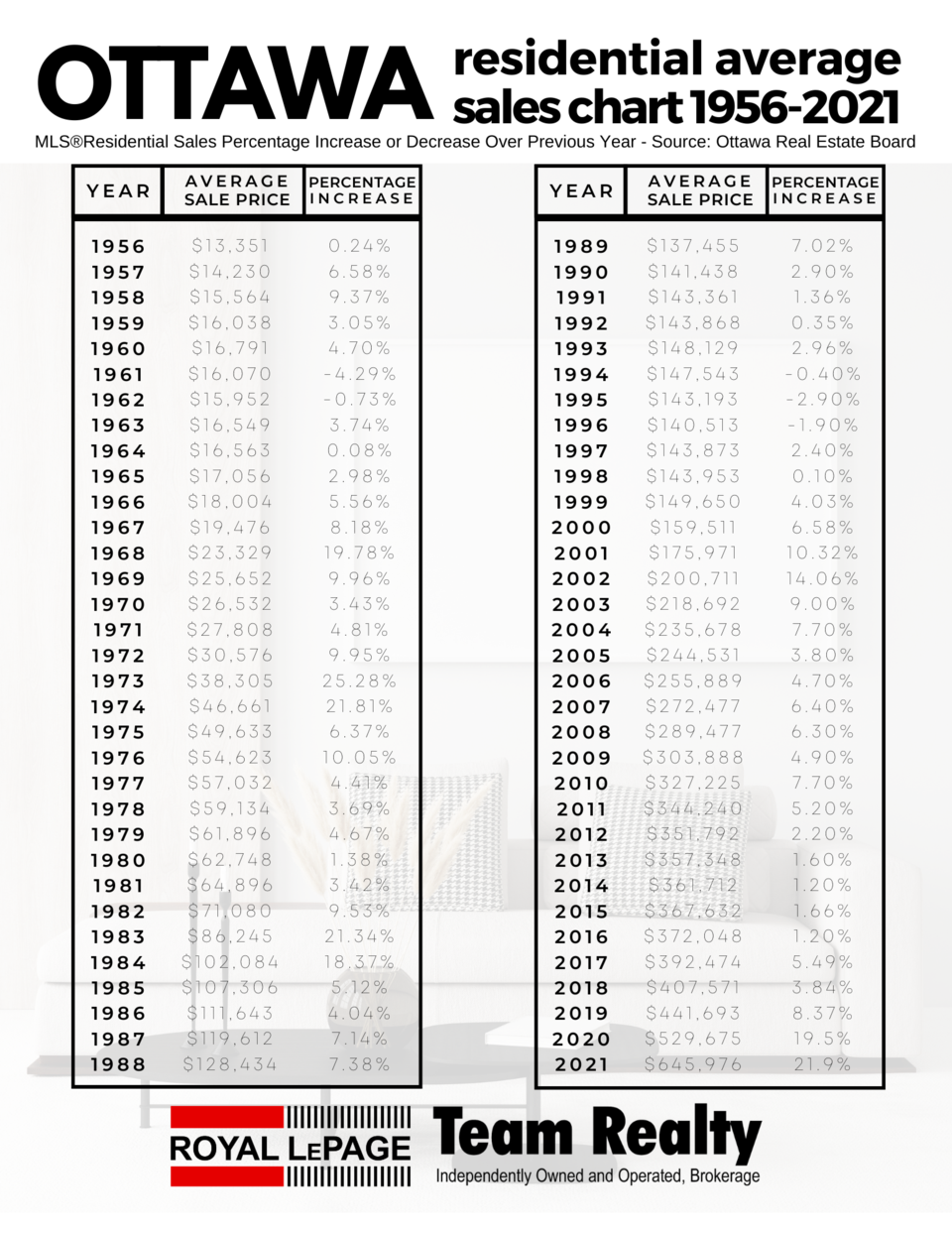

“But even as prices fluctuate, historically, real estate in Ottawa has always been and will continue to be stable and dependable in the long term. We aren’t likely to ever experience the significant dips that other regions may see. Prices won’t fall out; they are prone to level off to the reasonable rates of increase that we have historically experienced.”

“With an influx of 3,213 new listings in June, we are moving (albeit gradually) towards the goal of a more balanced market. Residential inventory has increased by 38% over last year at this time and is sitting at an approximate 1.9 months’ supply currently. Condominium housing stock has risen 14% to a 1.6 months’ supply for that property class. Once government-pledged supply measures are enacted, we are optimistic that goal is within reach.”

“Buyers, if you have been waiting on the sidelines, this may be an optimal time to venture back into your home search. There is more selection, fewer bidding wars, and less pressure to make a warp-speed decision. As for Sellers, your neighbourhood has its own characteristics and attributes that should weigh into the calculation of your property’s value. Contact a professional REALTOR® who has their hand on the pulse of Ottawa’s shifting real estate market today!”

REALTORS® also help with finding rentals and vetting potential tenants. Since the beginning of the year, OREB Members assisted clients with renting 2,919 properties compared to 2,252 last year at this time.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.