[Read more…]

[Read more…]Ottawa Real Estate News Release (OREB) – Ottawa Resale Market Stalls in August, Supply Challenges Persist

OTTAWA, September 8, 2023 – Members of the Ottawa Real Estate Board (OREB) sold 1,196 residential properties in August through the Board’s Multiple Listing Service® (MLS®) System, compared with 1,130 in August 2022, an increase of 6%. August’s sales included 903 in the freehold-property class, up 7% from a year ago, and 293 in the condominium-property category, a 2% increase from August 2022. The five-year average for total unit sales in August is 1,525.

“Sales activity was up marginally on a year-over-year basis in August but remained well below the historical average for this time of year,” says Ken Dekker, OREB President. “There is no shortage of demand given increased immigration and the large Canadian population cohort entering the market. The lack of suitable, affordable housing is a hindrance. High borrowing costs and economic uncertainty are impacting both sellers and buyers, which we expect will continue to result in further market fluctuations.”

Janice Myers, OREB CEO, highlights that these latest figures coincide with the City of Ottawa’s allocation of $110 million for affordable housing. “Even if interest rates were to drop and the economy stabilized, housing will remain out of reach for many Ottawa residents. Collaboration among all levels of government and stakeholders is vital to improving affordability for homeowners and tenants alike. And we need to expand provincial regulations, allowing four or more residential dwelling units on serviced lots, to promote higher-density housing.”

By the Numbers

Average Prices*:

- The average sale price for a freehold-class property in August was $709,739, an increase of 0.5% from 2022, and a 5.6% decrease over July 2023 prices.

- The average sale price for a condominium-class property was $425,968 an increase of 1% from a year ago, although 1.4% lower than July 2023 prices.

- With year-to-date average sale prices at $732,220 for freeholds and $432,571 for condos, these values represent an 8% decrease over 2022 for freehold-class properties and a 5.5% decrease for condominium-class properties.

- August’s new listings (2,228) increased 7% over August 2022 (2,090) and were on par with last month (2,234). The 5-year average for new listings in August is 2,177.

- Months of Inventory for the freehold-class properties has increased to 3 months from 2.9 months in August 2022 and 2.7 months in July 2023.

- Months of Inventory for condominium-class properties remains on par with August 2022 at 2.2 months, a slight decrease from 2.3 months in July 2023.

- Days on market (DOM) for freeholds have increased to 31 days from 25 days in August 2022 and 26 days in July 2023.

- Days on market (DOM) for condos have increased to 29 days from 28 days in August 2022 and 28 days in July 2023. REALTORS® also help with finding rentals and vetting potential tenants. Since the beginning of the year, OREB Members have assisted clients with renting 4,571 properties compared to 4,172 last year at this time, an increase of 10%.

Royal LePage House Price Survey – Homebuyers remain determined while sellers step back in response to additional interest rate hikes

According to the Royal LePage House Price Survey, the aggregate1 price of a home in Canada decreased modestly by 0.7 per cent year-over-year to $809,200 in the second quarter of 2023, indicating that nationally, the real estate market is close to the point where it will have recovered fully from 2022’s post-pandemic market correction. On a quarter-over-quarter basis, the aggregate price of a home in Canada rose 4.0 per cent in Q2. This was the second consecutive quarter to show positive growth following a rapid decline in prices over the last year as a result of the Bank of Canada’s aggressive interest rate hike campaign, which began in March of 2022.

“The Bank of Canada remains determined to bring inflation down to its target of less than three per cent. This has proven to be especially challenging at a time when the job market is so strong and Canadians continue to spend, partly due to a build-up of savings during the pandemic,” said Phil Soper, president and CEO of Royal LePage. “The Canadian real estate market has been in a steady state of recovery since the start of the year. While these additional interest rate hikes, and those potentially to come, will likely put a damper on activity and sales volumes, demand for housing remains very strong. We expect the rate of appreciation to moderate through the second half of 2023, causing home prices to level off or increase marginally.”

The Royal LePage National House Price Composite is compiled from proprietary property data nationally and in 62 of the nation’s largest real estate markets. When broken out by housing type, the national median price of a single-family detached home declined 2.0 per cent year-over- year to $841,900, while the median price of a condominium remained essentially flat, decreasing by just 0.4 per cent year-over-year to $586,900. On a quarter-over-quarter basis, the median price of a home in these property segments rose 4.1 and 2.7 per cent, respectively. Price data, which includes both resale and new build, is provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian real estate valuation company.

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 8.5 per cent in the fourth quarter of 2023, compared to the same quarter last year. The previous forecast has been revised upward to reflect strong activity and price appreciation in the first half of the year.

Learn more:

- National release: rlp.ca/Q2-2023-hps-release

- Regional analyses: rlp.ca/regional-releases

- Quebec Markets release: rlp.ca/Q2-2023-hps-release-Montreal

- House Price Survey Chart: rlp.ca/house-prices-Q2-2023

- Market Survey Forecast Chart: rlp.ca/market-forecast-Q2-2023

CREA Canadian Real Estate Association – National Statistics July 2023

CREA has recently issued its national statistics for July 2023. Highlights are:

- National home sales edged down 0.7% month-over-month in July.

- Actual (not seasonally adjusted) monthly activity came in 8.7% above July 2022.

- The number of newly listed properties rose 5.6% month-over-month.

- The MLS® Home Price Index (HPI) climbed 1.1% month-over-month and was down just 1.5% year-over-year.

- The actual (not seasonally adjusted) national average sale price posted a 6.3% year-over-year increase in July.

For New Condo Buyers, the Price has Got to be Right

An interesting article in the Globe and Mail with regards the construction of and the demand for new condominiums vis-à-vis the impact of the changing real estate market due to rising mortgage rates. Although for the Toronto market on a smaller scale the same applies to other cities.

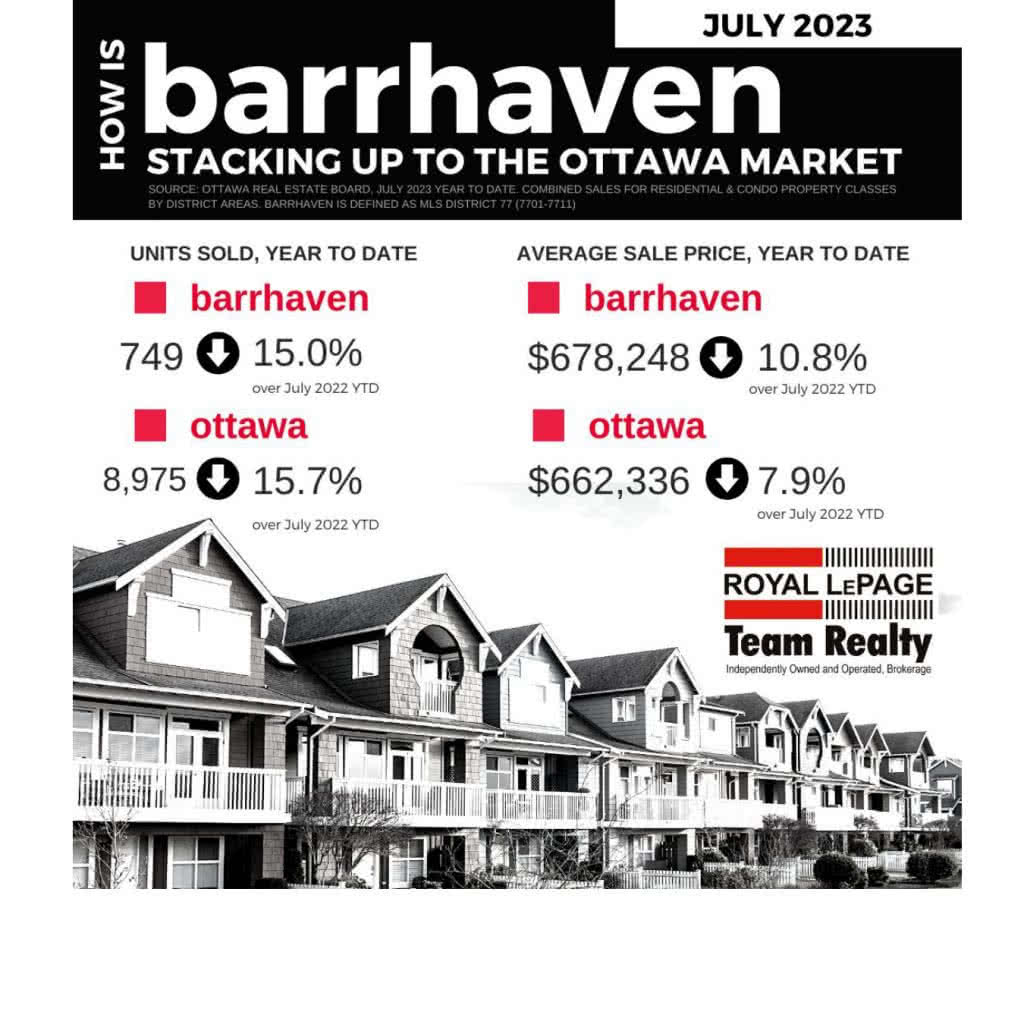

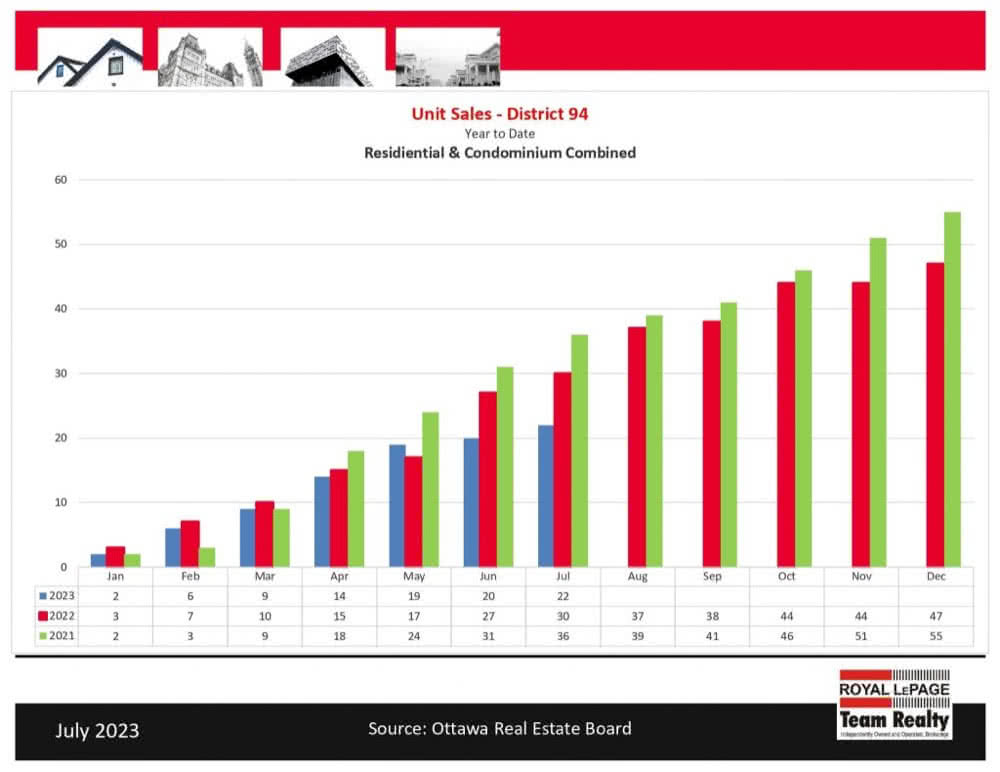

Ottawa Real Estate Statistics – July 2023 – Community Stats

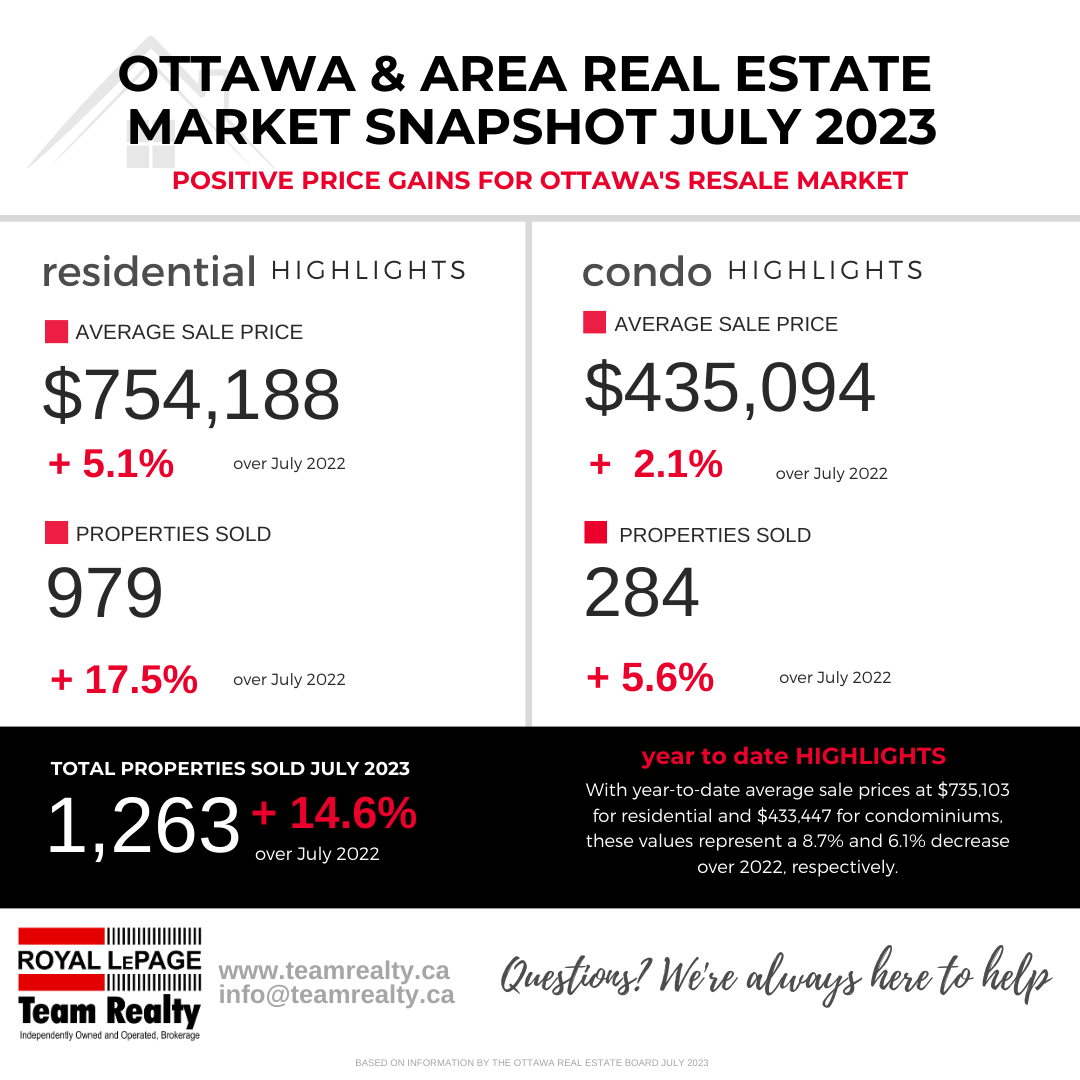

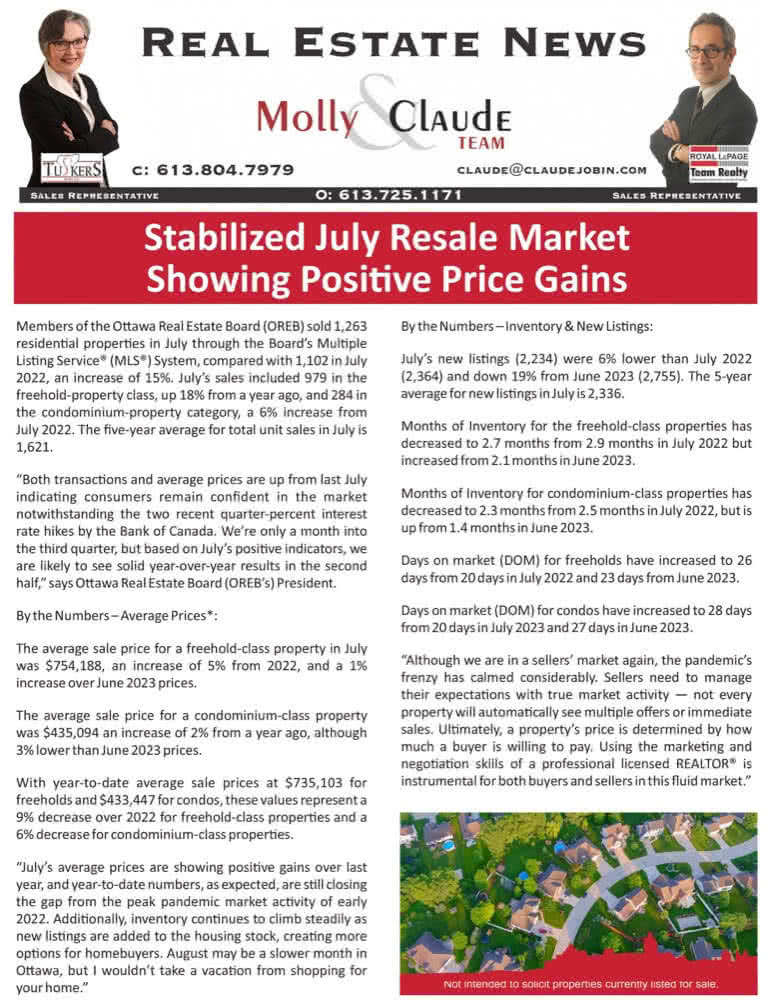

Ottawa Real Estate Statistics – July 2023

Ottawa Real Estate Newsletter – August 2023

Ottawa Home Prices Increase $37,800 year-over-year

This article by Josh Pringle of CTV News is mostly information you will have read in the Ottawa Real Estate Board News Release, however, the article ends with a 12 month table showing the fluctuation of home prices in Ottawa.

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 76

- Next Page »