[Read more…]

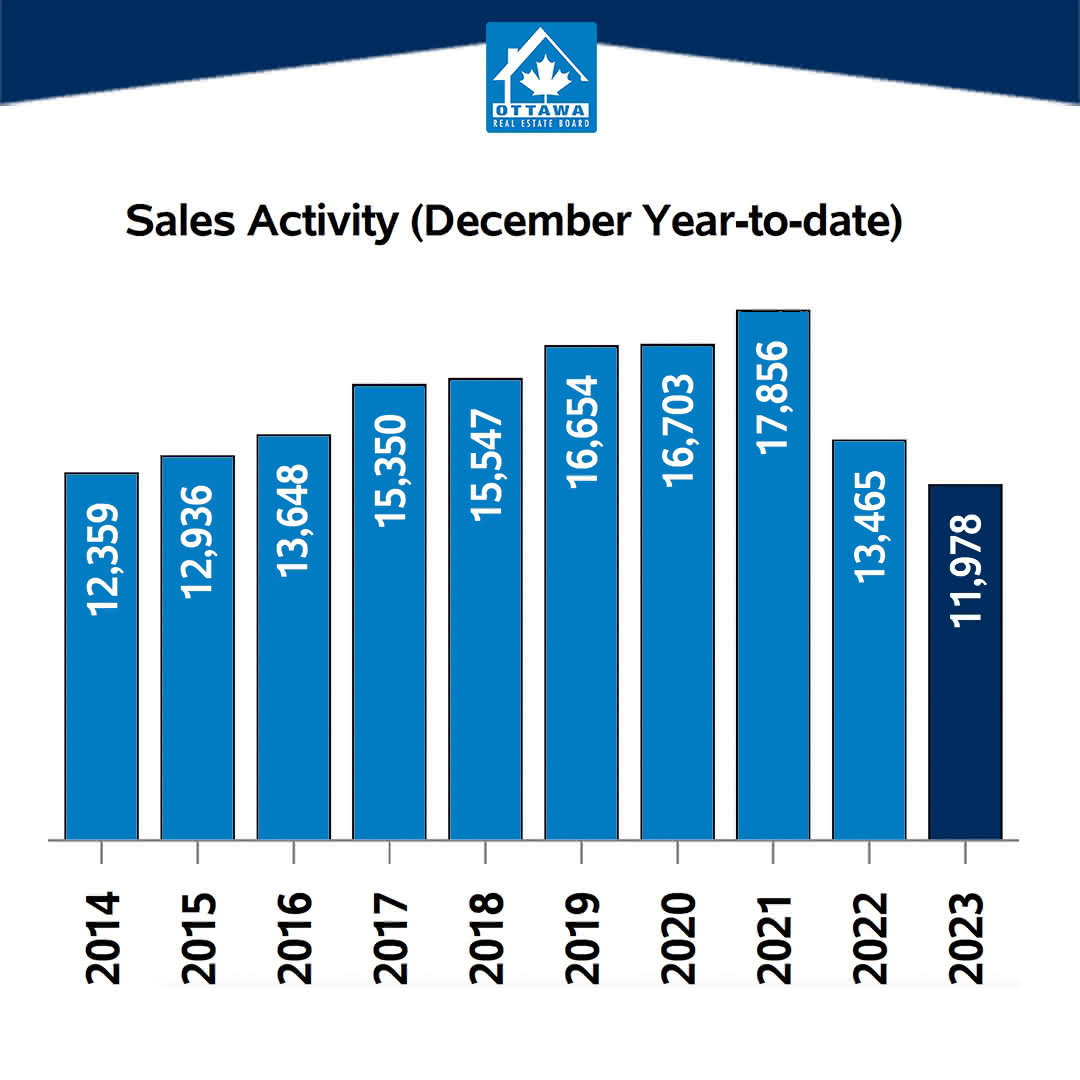

[Read more…]2023 was the slowest year for home sales in Ottawa in 13 years

Looking back at the year 2023 in Ottawa, real estate figures report, the number of sales is down and prices are down as well. CTV reports that 2023 was the slowest year in real estate since 20010, 13 years ago.

Link to video

Link to video

Ottawa Real Estate Statistics – December 2023

Ottawa Real Estate News Release (OREB) – Ottawa MLS® December Home Sales Close Out Year in Steady State

January 4, 2023

The number of homes sold through the MLS® System of the Ottawa Real Estate Board totalled 565 units in December 2023. This was an increase of 7.6% from December 2022.

Home sales were 16% below the five-year average and 11.9% below the 10-year average for the month of December.

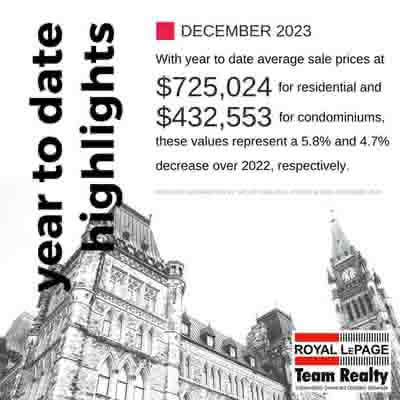

On a year-to-date basis, home sales totalled 11,978 units in all of 2023 — a decline of 11.0% from 2022.

“Ottawa’s resale market closed out the year in a steady, balanced state,” says OREB President Curtis Fillier. “This could be an early indication that consumer confidence is returning. We likely won’t see the full impact of rate stabilization until the second half of 2024, but December’s activity bodes well for a strong year ahead in Ottawa.”

“It hasn’t been the easiest market,” says Ken Dekker, OREB’s Past-President. “And while we probably won’t return to the peak levels seen in 2022, Ottawa’s market is poised to recover any ground lost in the past year. Both buyers and sellers need extra patience right now, but solid opportunities are there.”

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures.

- The overall MLS® HPI composite benchmark price was $623,900 in December 2023, a modest gain of 2.7% from December 2022.

- The benchmark price for single-family homes was $704,900, up 2.7% on a year-over-year basis in December.

- By comparison, the benchmark price for a townhouse/row unit was $481,100, up 4.2% compared to a year earlier.

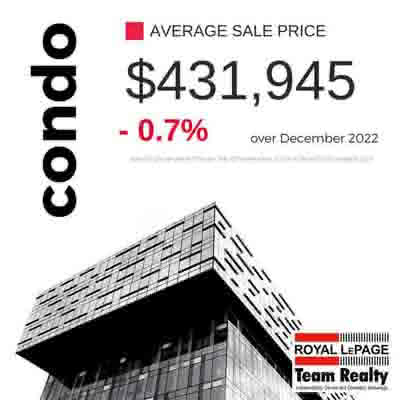

- The benchmark apartment price was $417,200, up 2.1% from year-ago levels.

- The average price of homes sold in December 2023 was $632,487, increasing 1.7% from December 2022. The more comprehensive year-to-date average price was $667,794, a decline of 5.5% from 2022.

- The dollar value of all home sales in December 2023 was $357.3 million, up 9.4% from the same month in 2022.

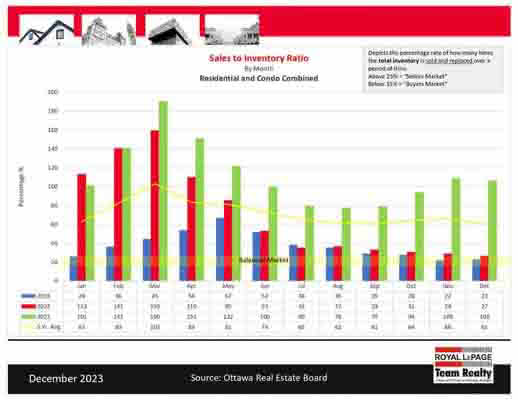

By the Numbers – Inventory & New Listings

- The number of new listings saw a major decrease of 12.4% from December2022. There were 523 new residential listings in December 2023. New listings were 4% below the five-year average and 16.1% below the 10-year average for the month of December.

- Active residential listings numbered 1,844 units on the market at the end of December, a gain of 3.0% from the end of December 2022.

- Active listings were 55.5% above the five-year average and 17.2% below the 10-year average for the month of December.

- Months of inventory numbered 3.3 at the end of December 2023, down from the 3.4 months recorded at the end of December 2022. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

Real Estate Investment Tips to Start a New Year

Here is a list of real investement tips proposed by Canadian Real Estate Magazine.

As the new year begins, real estate investors across Canada are looking for strategies to maximize returns and minimize risks. Here are several key tips to consider when navigating the real estate market.

- Analyze 2023 Market Trends: Real estate markets vary significantly across provinces and even cities. Investors should stay informed about local market conditions, including housing demand, rental rates, and population growth. Understanding the trends from the previous year can help in making informed decisions about where and when to invest in the new one.

- Set Clear Goals: Define what you want to achieve with your real estate investments. Are you looking for long-term growth, cash flow, or a quick flip? Your strategy will differ based on your objectives. Whether it’s generating passive income through rental properties or capitalizing on property appreciation, having clear goals helps align your actions with your financial expectations.

- Diversify Your Portfolio: Diversification is key to mitigating risk. Consider investing in different types of properties, such as residential, commercial, or industrial, or in different geographic locations. This approach can provide a safety net against market fluctuations.

- Financing and Leverage: Understand your financing options. Leveraging your investment can amplify your return on investment, but it also increases risk. Ensure you have a solid financing plan in place, and consider the implications of mortgage rates and lending laws in Canada.

- Build a Network: The new year is a great time to start strengthening your professional network. Networking with other investors, real estate agents, and industry professionals can provide valuable insights and opportunities. Attend local real estate meetings or join online forums to stay connected with trends, deals, and valuable tips.

- Consider Tax Implications: Be aware of the tax implications of your real estate investments. Canada has specific rules regarding investment properties, including how rental income is taxed and the implications of selling a property. Consulting with a tax professional can help optimize your investment strategy for tax efficiency.

- Regularly Review Your Portfolio: Real estate isn’t a set-it-and-forget-it type of investment. Regularly review your portfolio’s performance and the condition of your properties. Be prepared to make adjustments as market conditions, personal goals, or financial situations change.

New Year – New Tax Measures

The government is introducing several new tax measures in 2024. Most pertinent to real estate is the change to the short-term rental deduction, making it less attractive for owners to rent out their properties on Airbnb. The principal goal being to take these properties out of the short term rental arena and put them into long term rental to ease the housing shortage

Beyond the change to short-term rentals, the government has made announcements re the following:

- GST exemptions

- The CPP pension enhancement

- The alternative minimum tax

- Other notable tax changes for 2024

- Income taxes, EI premiums and TFSAs

- The ‘sneaky’ change to bare trusts

- « Previous Page

- 1

- …

- 41

- 42

- 43

- 44

- 45

- …

- 619

- Next Page »