Here’s a detailed look at the condo options at the addresses you mentioned in Vanier, Ottawa:

- 135 Barrette Street – St Charles Market: This is a high-end development with prices ranging from $519,900 to $4.55 million. Amenities include concierge services, a fitness center, sauna, and outdoor BBQ areas.

- 222 Beechwood Avenue – Minto Beechwood: Condos at this address are part of a modern development known for quality finishes and community amenities.

- 270-272 Beechwood Avenue – Rockcliffe Terrace: These units have recently sold for between $170,000 and $298,500, and the building includes shared laundry facilities and covers utilities like heat and water in the condo fee.

- 384-392-404-420 Blake Boulevard: Affordable, well maintained low rise buildings in the heart of Vanier.

- 20 Charlevoix Street: Stacked townhouse, some one storey some two, either with a garden or a large veranda.

- 30 Charlevoix Street: A chic urban boutique size condo by Barry Hobin.

- 320 Cyr Street: Small building with mostly 2 bedroom condos.

- 297 Dupuis Street: Century old conversion. Loft style condos.

- 213 Gladu Street: Eastgarden condos provide 2 bedroom condos.

- 200 Lafontaine Avenue: Spacious 2 bedroom condos and a well maintained building.

- 40 Landry Avenue – La Renaissance: Offers amenities like an indoor pool, sauna, and exercise room. Recent sales show units selling for between $340,083 and $405,443.

- 70 Landry Street – La Tiffani I: Known for solid value and amenities like an exercise room and party room. It’s located in a vibrant area close to shopping and dining.

- 90 Landry Street – La Tiffani 2: This building offers modern one-bedroom and one-bedroom-plus-den units with features such as den spaces and upgraded finishes.

- 7 Marquette Avenue – Kavanaugh: Features a variety of units including one-bedroom and one-bedroom-plus-den configurations, with amenities that enhance modern living.

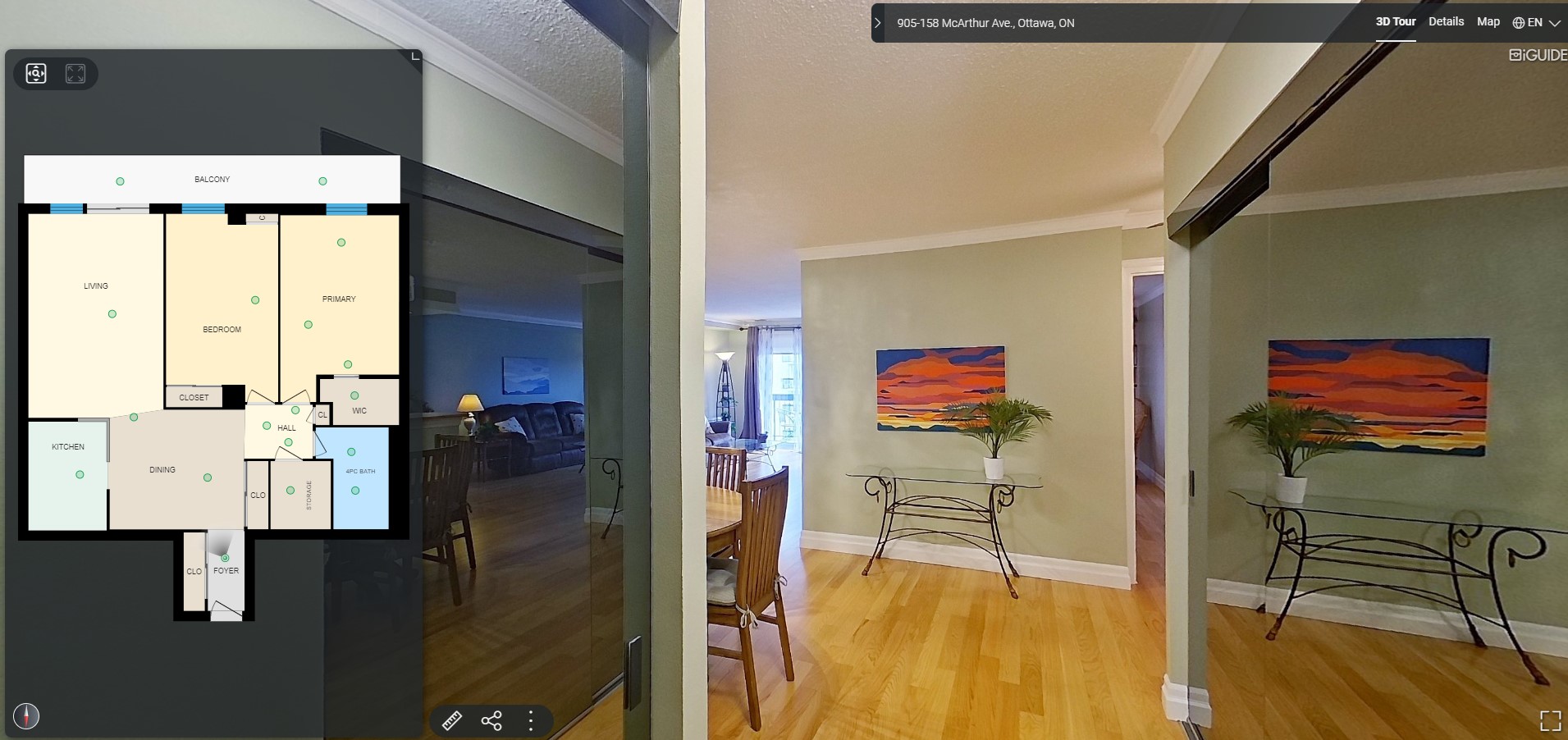

- 158 McArthur Avenue – Chateau Vanier: This building offers a range of amenities including a pool, sauna, and underground parking. Recent sales have shown an active market with units selling within a range of $203,332 to $310,497.

- 240-417 Meilleur Private & 254-409 Montfort Street: Specific condo details at these addresses were not available.

- 369 North River Road: Les Terrace Amelie spacious condos in a fabulous location.

- 316 Savard Avenue: Les Terraces de la Promenade, a well run and quiet adult oriented 3-storey brick building.

- 345 St Denis Street: School conversion. Spacious condos with high ceilings. Some in original school, some in addition.