Real Estate News Ottawa

The Ottawa Real Estate Board will soon issue the March news release presenting the February statistics, in the interim here is a snapshot of the Ottawa’s real estate market, there are several key developments and trends to note:

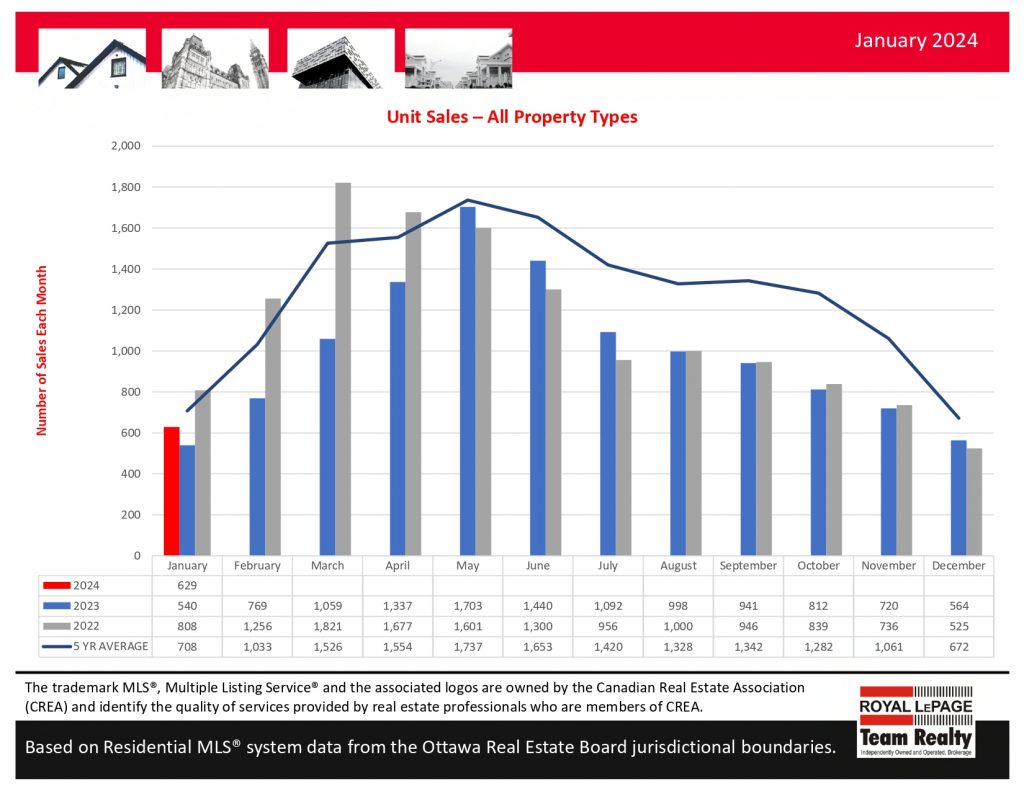

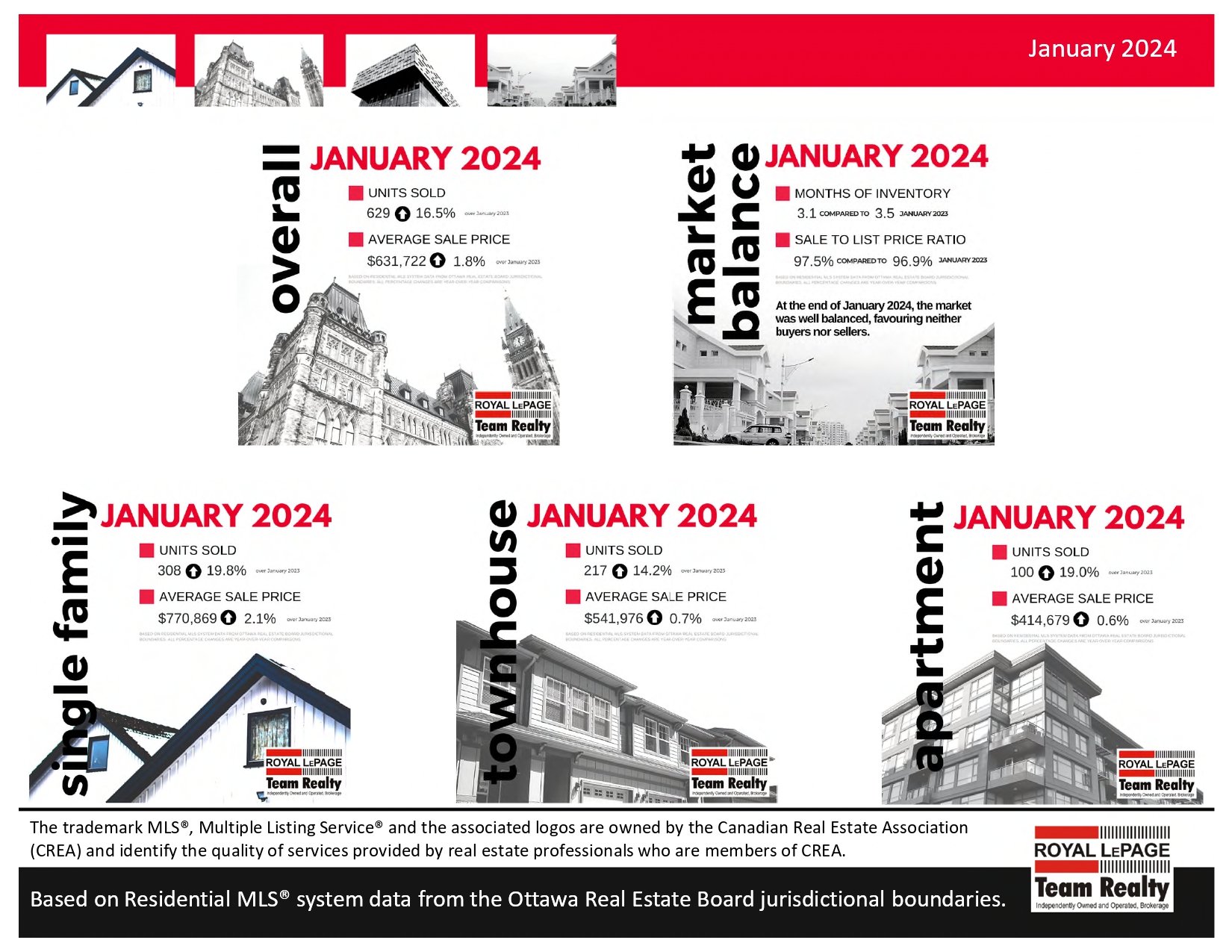

- Market Activity and Prices: The Ottawa housing market experienced an increase in sales activity in January 2024, with sales rising by 11.3% compared to the previous month. This rebound comes after a period of seven consecutive months of declining sales activity. Despite this increase, sales remain below the 5-year and 10-year averages for January. The average home price in Ottawa for January 2024 was $631,722, marking a slight decrease of 0.1% from the previous month but a 3.1% increase from January 2023. The market is described as balanced, with a Sales-to-New Listings Ratio (SNLR) of 49%, indicating neither a seller’s nor a buyer’s market.

- Inventory Levels and Market Conditions: January 2024 saw 629 home sales, a 4.3% increase compared to January 2023. New listings surged by 143% from the previous month, totaling 1,271, and were 7.3% higher than in January 2023. The active listings at the end of January 2024 stood at 1,961, with 3.1 months of inventory available, suggesting a relatively stable supply of homes on the market.

- Property Types and Prices: Different property types experienced varying degrees of price adjustments and sales volume changes. Single-family homes saw a median selling price of $699,995 in January 2024, up 2.2% from the previous year. Townhouses had a median price of $555,000, a slight increase of 0.5% year-over-year. Apartments remained steady with an average price of $375,000, unchanged from the previous year.

- Future Price Predictions: Housing prices in Ottawa are expected to increase by an average of 4.5% by the end of 2024. This forecast suggests a return to more normal market conditions after periods of volatility.

Ottawa Condos for Sale

Centre Town

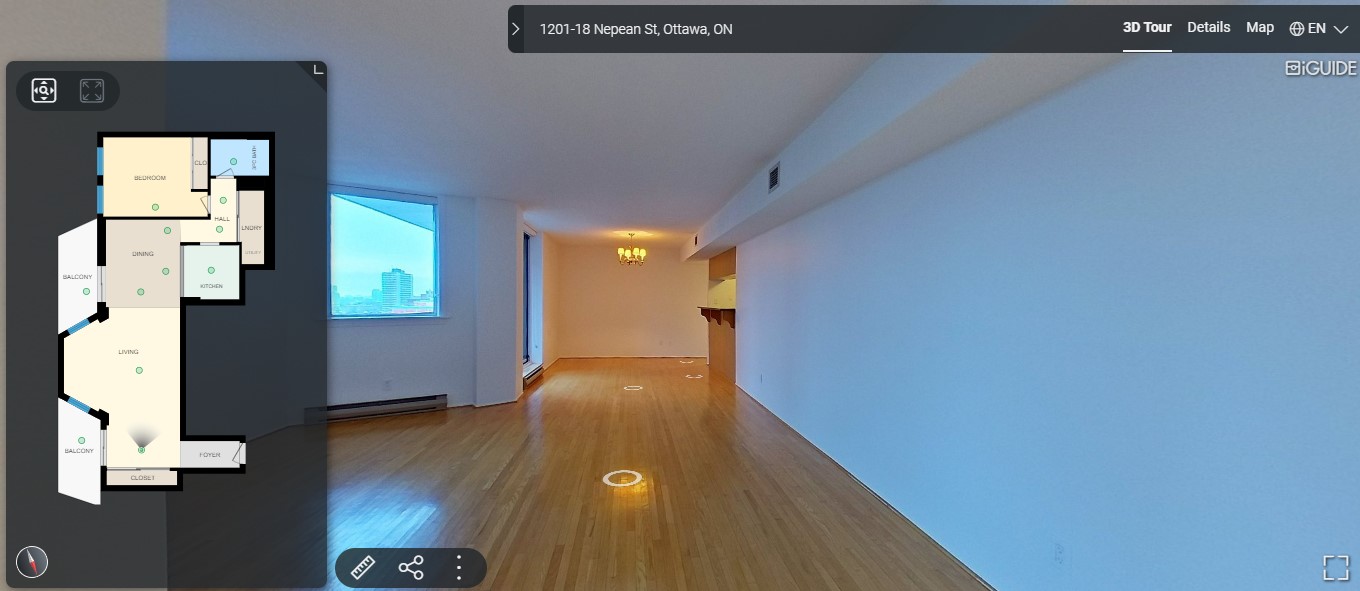

1201-18 Nepean Street

$375,000

Virtual Tour

Virtual Tour

Welcome to 1201-18 Nepean Street, where the combination of space, air conditioning, and in-suite laundry is a unique find in downtown at this price point. This bright, open-concept suite, recently painted and boasting 800 square feet (as per iguide), features two balconies and hardwood floors throughout. The main room stretches over 30 feet, offering ample living space. The kitchen has been updated with granite countertops and stainless-steel appliances. Enjoy the convenience of in-suite laundry with a brand-new washer and dryer. The bathroom has been renovated to include a walk-in shower, situated next to a spacious bedroom. This move-in-ready property is your gateway to the best of downtown living! Located just steps away from the canal, Parliament Hill, Sparks Street, the National Arts Centre, and the Rideau Centre, 18 Nepean Street places you right in the midst of all the action.

Ottawa Real Estate Statistics – January 2024

The monthly statistics snapshots have changed this month. Rather then residential, condo, they are single family, townhouse, and apartment.

[Read more…]

Merry Christmas!

Merry Christmas to you, your family, and your friends. May this holiday season be all that you’d like it to be.

First a cute video featuring the Gardiner Brothers

Then a little humour with Mr Bean

Keep track of where santa is with the santa tracker

Finally some jazz christmas music to accompany you while you prepare, entertain, and recover.

Ottawa Real Estate Statistics – November – Community Stats

Details to come

Ottawa Real Estate News Release (OREB) – Ottawa MLS® Home Sales Stable in November Amid Growing Supply

December 5, 2023

The number of homes sold through the MLS® System of the Ottawa Real Estate Board totaled 724 units in November 2023. This was a small reduction of 1.6% from November 2022.

Home sales were 31.8% below the five-year average and 27.4% below the 10-year average for the month of November.

On a year-to-date basis, home sales totaled 11,421 units after 11 months of the year. This was a decline of 11.7% from the same period in 2022.

“Sales are performing as expected with the arrival of colder months, and an uptick in new and active listings is bringing more choice back into the market,” says OREB President Ken Dekker. “While more choice may mean the pace of buying and selling has slowed, that doesn’t mean people looking to enter or upgrade in the market should sit back. Prospective buyers or those looking to upgrade have an opportunity to collaborate with their REALTOR® to carefully explore the market, identify the ideal property, and negotiate an attractive deal at their own pace. Sellers will have to manage their expectations regarding the quantity of offers and speed of transactions, and their REALTOR® is the best resource to help them confidently price and prepare their home for a quality sale.”

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures.

- The overall MLS® HPI composite benchmark price was $628,900 in November 2023, nearly unchanged, up only 1.4% from November 2022.

- The benchmark price for single-family homes was $708,900, up 1.6% on a year-over-year.

- By comparison, the benchmark price for a townhouse was $492,300, nearly unchanged, up 0.8% compared to a year earlier.

- The benchmark apartment price was $424,300, up 1.2% from year-ago levels.

- The average price of homes sold in November 2023 was $633,138, decreasing 0.8% from November 2022. The more comprehensive year-to-date average price was $669,536, a decline of 5.7% from 11 months of 2022.

- The dollar value of all home sales in November 2023 was $458.4 million, down 2.4% from the same month in 2022.

- The number of new listings saw an increase of 2.7% from November 2022. There were 1,428 new residential listings in November 2023. New listings were 8.4% above the five-year average and 10.4% above the 10-year average for the month of November.

- Active residential listings numbered 2,752 units on the market at the end of November, a sizable gain of 15.8% from the end of November 2022.

- Active listings were 53.9% above the five-year average and 6.7% below the 10-year average for the month of November. Active listings haven’t been this high in the month of November in more than five years.

- Months of inventory numbered 3.8 at the end of November 2023, up from the 3.2 months recorded at the end of November 2022 and above the long-run average of 3.3 months for this time of year. The number of months of inventory is the number of months it would take to sell current inventories at the current rate of sales activity.

Additinal pics

Investing in the Future: The Do’s and Don’ts of Buying a Rental Property

The CanadianRealEstateMagazine has put together a list of do’s and don’ts of buying a rental property. The list includes the following questions and answers.

- The Benefits of Investing in Rental Properties

- How to Choose the right property

- Understanding the financial implications

- The do’s of buying a rental property

- Conduction market research

- Getting a professional property inspection

- Securing the right financing

- Understanding landlord-tenant laws in Canada

- The don’ts of buying a rental property

- Avoiding over-leveraging

- Not neglecting property management

- Ignoring the importance of a good tenant screening process

- Legal considerations when buying a rental property

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 38

- Next Page »