On Thursday, April 11, Finance Minister Chrystia Freeland announced several important changes aimed at supporting first-time homebuyers and enhancing housing affordability in Canada. Here are the key points:

On Thursday, April 11, Finance Minister Chrystia Freeland announced several important changes aimed at supporting first-time homebuyers and enhancing housing affordability in Canada. Here are the key points:

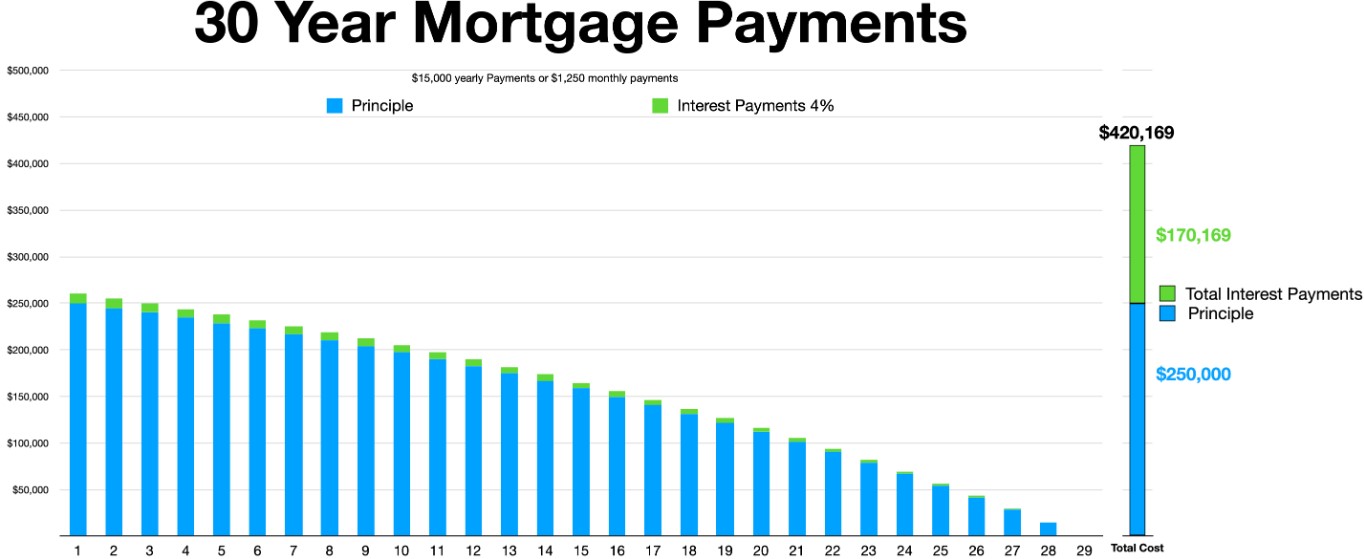

- Extended Amortization for Insured Mortgages: The government will allow 30-year amortization periods for insured mortgages specifically for first-time homebuyers purchasing newly built homes. This measure is designed to make monthly mortgage payments more affordable by spreading them over a longer period.

- Enhancements to the RRSP Home Buyers’ Plan (HBP): Freeland announced improvements to the Registered Retirement Savings Plan (RRSP) Home Buyers’ Plan, which allows first-time buyers to withdraw funds from their RRSPs to purchase a home. The specifics of these enhancements were not detailed in the initial summary but are aimed at increasing the accessibility of the program for prospective homeowners.