The following is an analysis by Robert Hogue is a member of the Macroeconomic and Regional Analysis Group, with RBC Economics. He is responsible for providing analysis and forecasts for the Canadian housing market and for the provincial economies. His publications include Housing Trends and Affordability, Provincial Outlook and provincial budget commentaries. Should you wish more detail click here to be taken to the article with interactive charts within the RBC.

In the end, the rollercoaster that was 2020 left Canada’s housing market more or less where it started the year: full of bidding wars, escalating prices and exasperated buyers unable to find a home they can afford. The pandemic changed some dynamics—it drove many buyers to the suburbs, exurbs and beyond, ground immigration to virtual halt, triggered a downturn in big cities’ rental markets and caused households to build up their savings—but it didn’t dial down the market’s heat. We expect this to largely continue in 2021. We see little that will stop activity or prices from reaching new heights in the year ahead. We forecast the national benchmark price to rise 8.4% to $669,000 and home resales to increase 6.5% to 588,300 units with almost all provinces showing gains. Yet we also expect cooling signs to emerge, which will come into fuller display in 2022. The main restraining factors will be a lack of supply, waning pandemic-induced market churn, a modest creep-up in interest rates and an erosion of affordability. Call it a 2022 soft landing. Of course, we can’t exclude the possibility of a rougher landing—either in 2022 or earlier—so long as the pandemic remains a threat to our economy though large-scale vaccination campaigns should mitigate that risk.

Property values have more upside

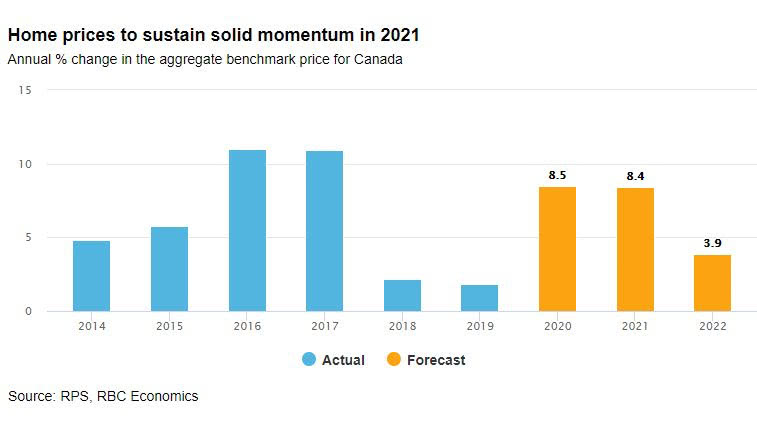

Not only did home price increases stay on track throughout the pandemic, the pace quickened. The aggregate benchmark price increased 8.5% in Canada in 2020, or almost five times the rate of 1.8% in 2019. We expect this solid momentum to be sustained in 2021 with a gain of 8.4%, underpinned by tight demand-supply conditions in most regions of the country. We see price support softening gradually over the course of the year, though, setting the stage for a more modest 3.9% appreciation in 2022.

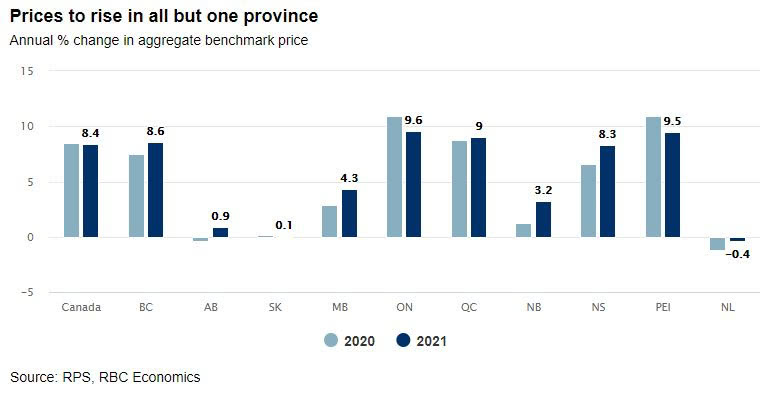

Gains will be strongest in Central Canada, BC and parts of Atlantic Canada

We project price trends to stay firm in most regions of the country, taking property values up 9.6% in Ontario, 9.0% in Quebec, 8.6% in BC, 8.3% in Nova Scotia and 9.5% in PEI—building on 2020’s solid gains. The outlook for the Prairie Provinces remains comparatively weaker. The economic challenges facing the region will continue to weigh on prices though we expect an increase in Alberta (0.9%) after nearly five years of decline. Newfoundland and Labrador is the only province for which we forecast prices to drop in 2021 (-0.4%)—for the sixth year in a row. It’s important to note the upswing in property values in BC, Ontario and Quebec isn’t just a big-market story. The pandemic has heated up prices in smaller markets too. In fact, we could see stronger gains in smaller markets than in core urban areas because downtown condo prices are likely to stay flat through much of 2021.

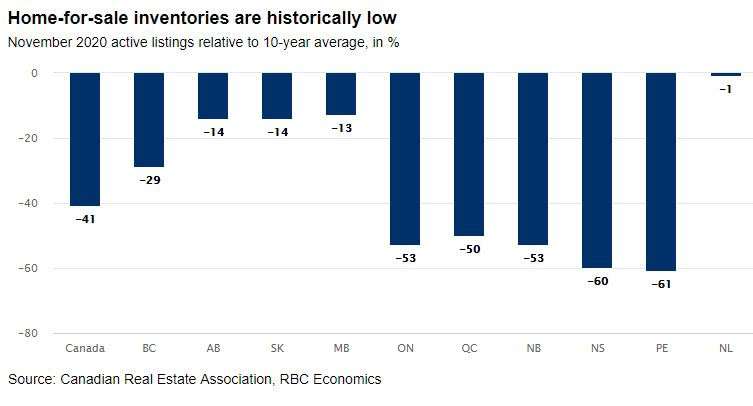

Buyers will keep bidding up prices because inventories are scarce…

Low available supply is the reason property values will continue to go up. Strong demand pre-pandemic and the historic market rally since summer have cleaned up inventories in many parts of the country. Relative to the 10-year average, active listings had plummeted between 50% and 61% in Ontario, Quebec and most of Atlantic Canada, and 29% in BC by the late stages of 2020. And that’s despite a surge in downtown condo listings since spring in Canada’s largest cities. With so few options to choose from (outside downtown condos), buyers will continue to compete fiercely. Buyers in the Prairie Provinces, and Newfoundland and Labrador, however, will feel less pressure to outbid each other given supply isn’t quite as scarce in these markets.

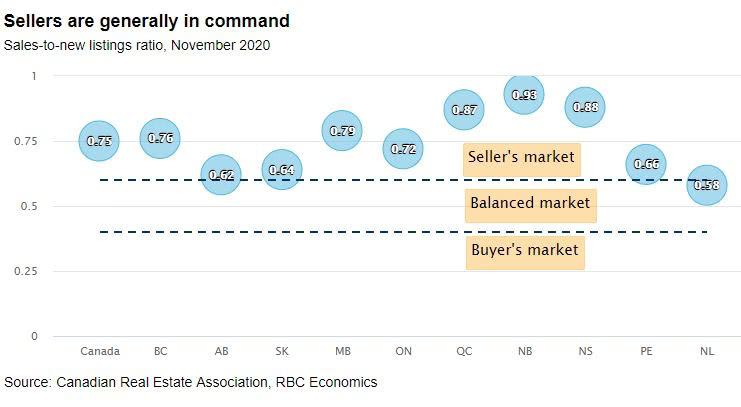

… and sellers are calling the shots

Viewed from another angle, sellers enter 2021 holding a very strong hand when setting prices in most of Canada. We see this continuing during most of 2021. We expect provincial sales-to-new listings ratios—a reliable gauge of price pressure—to generally stay above the threshold (0.60) where sellers have historically yielded more pricing power. In several cases (including BC, Ontario and Quebec), ratios are well above the threshold, providing plenty of buffer against demand-supply conditions flipping in favour of buyers.

Supercharged demand to drive up home resales to a second-straight record

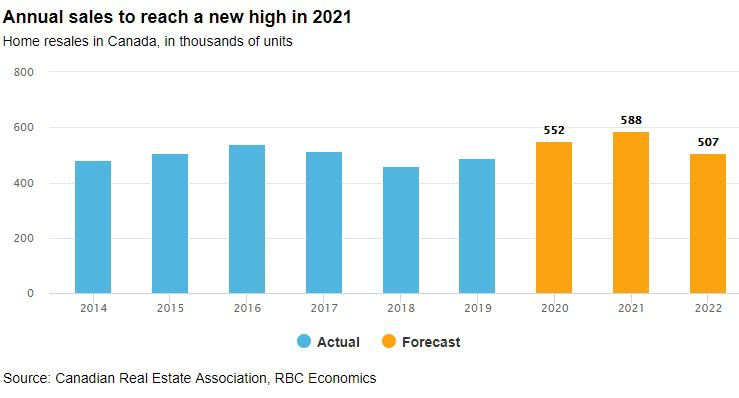

Despite the pandemic virtually stalling activity last spring, Canada’s housing market likely had its strongest year ever in 2020. We estimate home resales rose nearly 13% to 552,300 units nationwide, surpassing the previous record of 539,100 units set in 2016. The spring setback was more than made up by surging activity in the summer and fall. We project resales to be even stronger overall in 2021, reaching 588,300 units. Historically low interest rates, changing housing needs, high household savings and improving consumer confidence will keep demand supercharged.

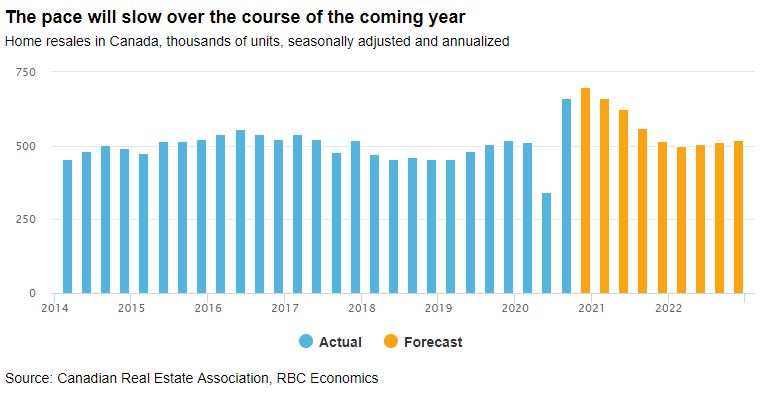

Cooling signs will emerge… eventually

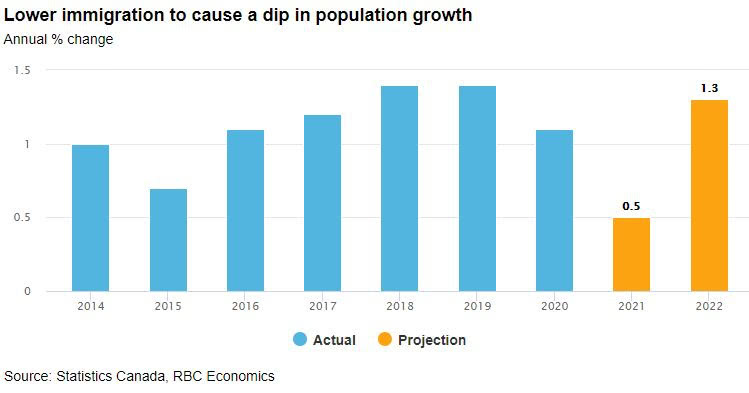

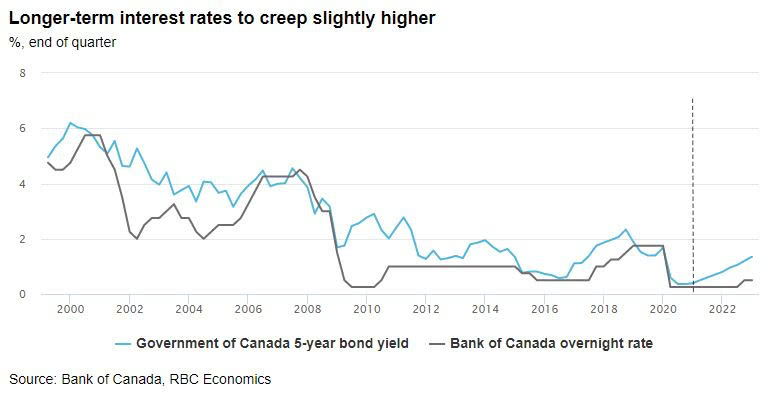

The strong annual tally will mask a gradual cooling in the market through the year, however. We believe the lofty levels of activity attained at the end of 2020—nearing 700,000 units on an annualized basis in the fourth quarter—won’t be sustained, and some moderation will set in over the course of the year. We expect low supply to become a growing constraint, pandemic-induced market churn (resulting from changes in housing needs) to wane, and a slight rise in longer-term interest rates and material erosion of affordability to cool demand by a few degrees. Low immigration levels could also play a role. Our view is these factors will rein in resales to something closer to 515,000 units by the end of the year—still solid but down from the stratosphere.

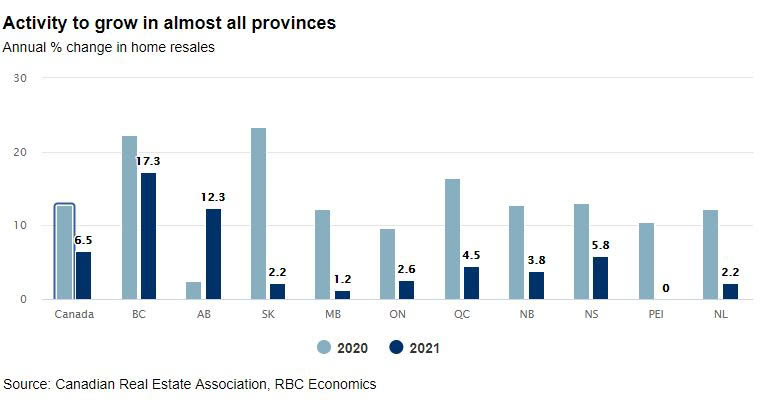

All provincial markets but one (PEI) to stay in growth mode

Home resales rose in all provincial markets in 2020—the last time this happened was in 2004. We expect a near-repeat performance in 2021 with only PEI bucking the trend (with resales remaining unchanged close to a record level). Still, rates of increase will generally slow. We project activity in BC and Alberta to grow the most, at 17% and 12%, respectively. In both cases, this will reflect further recovery of ground lost years earlier. These provincial markets had slumped prior to 2020. Forecasted gains are more modest for most other provinces, ranging from 1.2% in Manitoba to 5.8% in Nova Scotia. We believe supply constraints will be a particular issue holding back the pace in Central Canada and most of the Atlantic Provinces. High sensitivity to interest rates poses a potential risk…

High sensitivity to interest rates poses a potential risk…

The decline in interest rates since last spring gave a sizable break to buyers by lowering debt service costs. This has undoubtedly attracted more buyers into the market. We expect interest rates to stay low though we see long-term rates starting to creep slightly higher this year. It’s important to remember that when rates are at rock-bottom levels like they are today, it doesn’t take much of an increase to jack up debt service costs. So the slightest rate increase could compel many buyers to exit. Any sudden, larger increase would pose a risk to the market.

…and so do low immigration levels

There are several other risks to be mindful of. The pandemic is obviously a top one, having the potential to severely disrupt activity. The good news is mass immunization is in sight, which should mitigate some of that risk. Slumping immigration, if it continues, could sap housing demand. To date, the plunge in immigration has primarily affected the rental and, to a lesser extent, condo markets in Canada’s largest cities though the impact could spread to other housing categories and markets. Strong immigration has been a huge source of housing demand over the past decade. Finally, should signs of market overheating emerge, this could prompt policymakers to intervene by tightening rules or imposing new restrictions in order to cool things down.